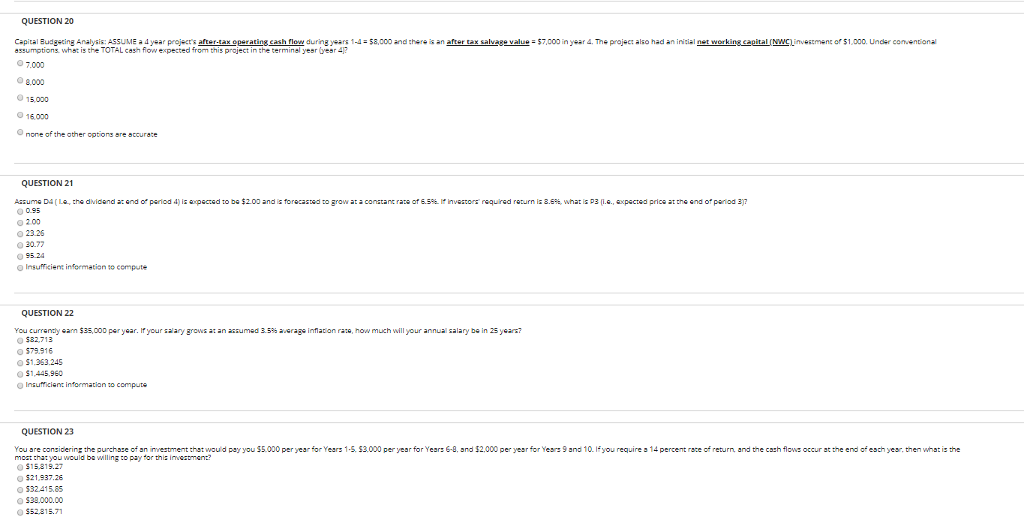

Question: QUESTION 20 Capital Budgecing Analysis: ASSUME 4year project's after-tax operating cash flow during years 1--58,000 and there is an after tax salvaee value $7,000 in

QUESTION 20 Capital Budgecing Analysis: ASSUME 4year project's after-tax operating cash flow during years 1--58,000 and there is an after tax salvaee value $7,000 in year 4. The projec also had an initial net working capital NW)investment of $1,000. Under conventional assumptions what is the TOTAL cash fow expected from this praject in the terminel yesr (yesr 4 O 8.000 15.000 16.000 Onone of the other options are accurate QUESTION 21 Aasume D4 ? La, the dividend ac ed oc period 4) is ? pected to be 200 and is forecasted to grow at?constanc rate of 6.59&?invastors, requred racurn is 3.69, what is p3?.?.. ?pected prioa at the end of penod 3)? 0.95 o 2.00 ? 23.26 0 30.77 0 95.24 QUESTION 22 You current earn $35,000 per year. If your salary grows at an assumed 3.5% -erage inflaton rate, how much will your annual salary be in 25 years? $82,713 o $79.916 O S1,353.245 O $1,445,960 QUESTION 23 ODO per year for Years 6 and ?2 000 per year or Year: 9 and 10. ; you require ? 14 percent race of return and me cash flow: occur at the end of each year. You are considering the purchase of an m es ent th at oud par you S 000 per year for Years 1 S S moat tha: you would ba willingE to pay or this ineatmena en what is the S15.8 19.27 21,937.26 3241585 ? s32.000.00 552.315.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts