Question: Question 20 In the analysis of net present value profiles, a crossover rate will occur for two mutually exclusive projects when a difference occurs in

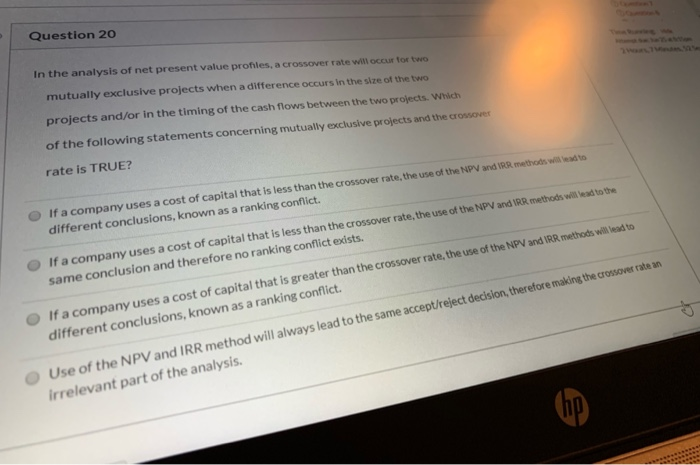

Question 20 In the analysis of net present value profiles, a crossover rate will occur for two mutually exclusive projects when a difference occurs in the size of the two projects and/or in the timing of the cash flows between the two projects. Which of the following statements concerning mutually exclusive projects and the crossover rate is TRUE? If a company uses a cost of capital that is less than the crossover rate, the use of the NPV and IRR methods wito different conclusions, known as a ranking conflict. If a company uses a cost of capital that is less than the crossover rate, the use of the NPV and IRR methods will lead to the same conclusion and therefore no ranking conflict exists. If a company uses a cost of capital that is greater than the crossover rate, the use of the NPV and IRR methods will lead to different conclusions, known as a ranking conflict. Use of the NPV and IRR method will always lead to the same accept/reject decision, therefore making the crossover rate an Irrelevant part of the analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts