Question: QUESTION (20 Marks) Muggic Pvt has an opportunity to develop new technology in its area of interest. It is forecasted that within four (4)

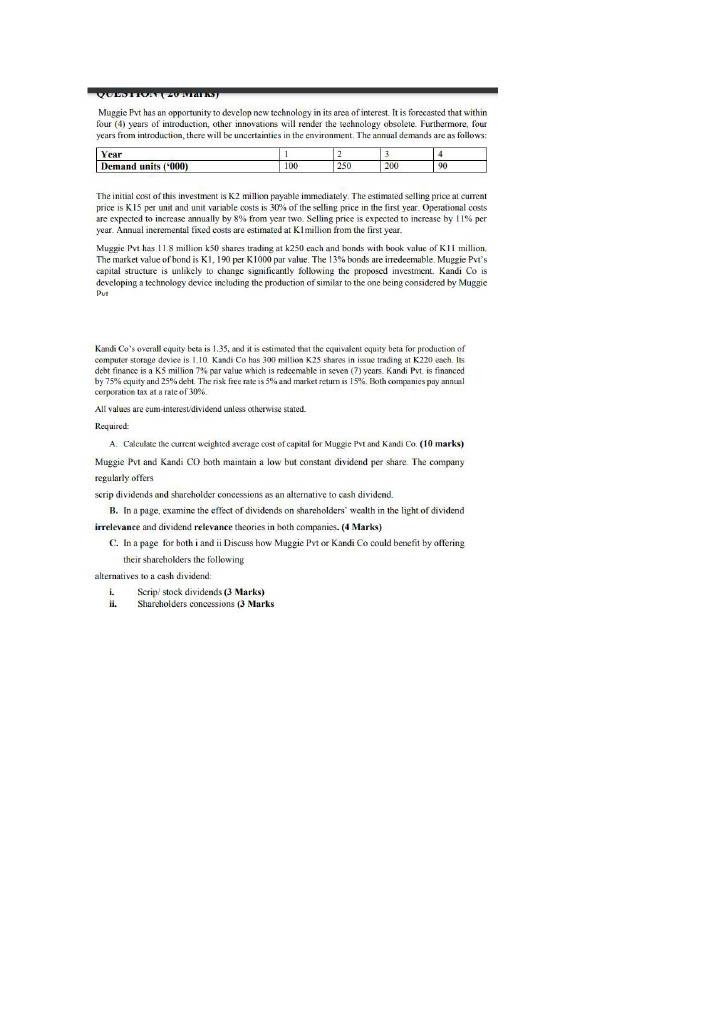

QUESTION (20 Marks) Muggic Pvt has an opportunity to develop new technology in its area of interest. It is forecasted that within four (4) years of introduction, other innovations will render the technology obsolete. Furthermore, four years from introduction, there will be uncertainties in the environment. The annual demands are as follows: Year Demand units ('000) 1 100 2 250 3 200 4 Scrip/ stock dividends (3 Marks) Shareholders concessions (3 Marks 90 The initial cost of this investment is K2 million payable immediately. The estimated selling price at current price is K15 per unit and unit variable costs is 30% of the selling price in the first year. Operational costs are expected to increase annually by 8% from year two. Selling price is expected to increase by 11% per year. Annual incremental fixed costs are estimated at K1million from the first year. Muggie Pvt has 11.8 million k50 shares trading at k250 each and bonds with book value of KII million, The market value of bond is K1, 190 per K1000 par value. The 13% bonds are irredeemable. Muggie Pvt's capital structure is unlikely to change significantly following the proposed investment. Kandi Co is developing a technology device including the production of similar to the one being considered by Muggie Put Kandi Co's overall equity beta is 1.35, and it is estimated that the equivalent oquity beta for production of computer storage device is 1.10. Kandi Co has 300 million K25 shares in issue trading at K220 each. Its debt finance is a K5 million 7% par value which is redeemable in seven (7) years. Kandi Pvt. is financed by 75% equity and 25% dent. The risk free rate is 5% and market return is 15%. Both companies pay annual corporation tax at a rate of 30%. All values are cum-interest dividend unless otherwise stated. Required: A. Calculate the current weighted average cost of capital for Muggie Pvt and Kandi Co. (10 marks) Muggie Pvt and Kandi CO both maintain a low but constant dividend per share. The company regularly offers scrip dividends and shareholder concessions as an alternative to cash dividend. B. In a page, examine the effect of dividends on shareholders wealth in the light of dividend irrelevance and dividend relevance theories in both companies. (4 Marks) C. In a page for both i and ii Discuss how Maggie Pvt or Kandi Co could benefit by offering their shareholders the following alternatives to a cash dividend: L

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

ANSWER A Muggie Pvts weighted average cost of capital 111 Kandi Cos weighted average cost of capital 126 B The dividend irrelevance theory states that ... View full answer

Get step-by-step solutions from verified subject matter experts