Question: question 20 needs to be solved. QUESTION 19 On Jan 22, 2020 YTM of available 10-year treasury note is 1.70% (annualized rate), with coupon rate

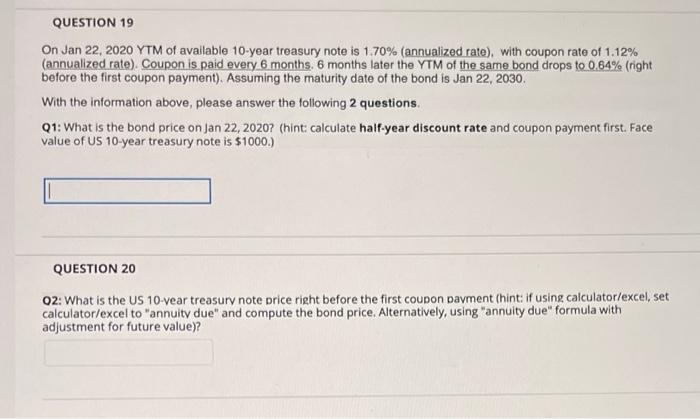

QUESTION 19 On Jan 22, 2020 YTM of available 10-year treasury note is 1.70% (annualized rate), with coupon rate of 1.12% (annualized rate). Coupon is paid every 6 months, 6 months later the YTM of the same bond drops to 0.64% (right before the first coupon payment). Assuming the maturity date of the bond is Jan 22, 2030. With the information above, please answer the following 2 questions. Q1: What is the bond price on Jan 22, 2020? (hint calculate half-year discount rate and coupon payment first. Face value of US 10-year treasury note is $1000.) QUESTION 20 02: What is the US 10-vear treasury note price right before the first coupon payment (hint: if using calculator/excel, set calculator/excel to "annuity due" and compute the bond price. Alternatively, using "annuity due" formula with adjustment for future value)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts