Question: Question 20 options: Balance sheet. Use the data from the financial statements of a company shown below. Use it to answer the 7 questions that

Question 20 options:

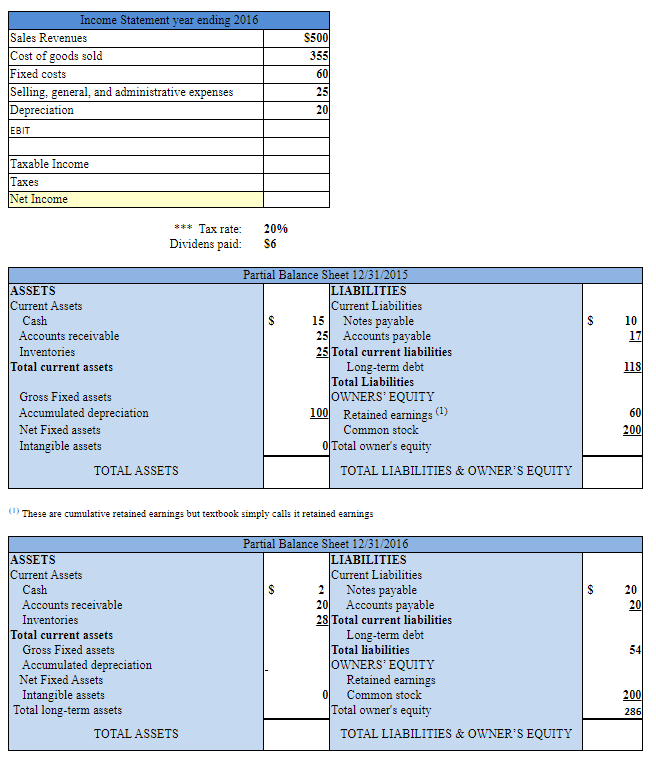

Balance sheet. Use the data from the financial statements of a company shown below. Use it to answer the 7 questions that follow it. When answering the questions (filling in the blanks), DO NOT use dollar signs, USE commas to separate thousands, DO NOT use parenthesis to denote negative numbers, USE the negative sign and place it in front of first digit of your answer when your answer is a negative number. Round to the nearest dollar.

| Income Statement year ending 2016 | |||

| Sales Revenues | $500 | ||

| Cost of goods sold | 355 | ||

| Fixed costs | 60 | ||

| Selling, general, and administrative expenses | 25 | ||

| Depreciation | 20 | ||

| EBIT | |||

| Taxable Income | |||

| Taxes | |||

| Net Income | |||

| *** Tax rate: | 20% | ||

| Dividens paid: | $6 | ||

| Partial Balance Sheet 12/31/2015 | |||

| ASSETS | LIABILITIES | ||

| Current Assets | Current Liabilities | ||

| Cash | $ 15 | Notes payable | $ 10 |

| Accounts receivable | 25 | Accounts payable | 17 |

| Inventories | 25 | Total current liabilities | |

| Total current assets | Long-term debt | 118 | |

| Total Liabilities | |||

| Gross Fixed assets | OWNERS EQUITY | ||

| Accumulated depreciation | 100 | Retained earnings (1) | 60 |

| Net Fixed assets | Common stock | 200 | |

| Intangible assets | 0 | Total owner's equity | |

| TOTAL ASSETS | TOTAL LIABILITIES & OWNERS EQUITY | ||

| (1) These are cumulative retained earnings but textbook simply calls it retained earnings | |||

| Partial Balance Sheet 12/31/2016 | |||

| ASSETS | LIABILITIES | ||

| Current Assets | Current Liabilities | ||

| Cash | $ 2 | Notes payable | $ 20 |

| Accounts receivable | 20 | Accounts payable | 20 |

| Inventories | 28 | Total current liabilities | |

| Total current assets | Long-term debt | ||

| Gross Fixed assets | Total liabilities | 54 | |

| Accumulated depreciation | OWNERS EQUITY | ||

| Net Fixed Assets | Retained earnings | ||

| Intangible assets | 0 | Common stock | 200 |

| Total long-term assets | Total owner's equity | 286 | |

| TOTAL ASSETS | TOTAL LIABILITIES & OWNERS EQUITY | ||

1. Earnings Before Interest and Taxes (EBIT) in 2016?

2. What is amount for Total Liabilities & Owner's Equity for 2015?

3. What is the change in Retained Earnings from 2015 to 2016?

4. What is the amount for Retained Earnings in the Balance Sheet in 2016?

5. What is the amount for Long-Term debt in the Balance Sheet in 2016?

6. What is the amount for Total Owner's Equity in the Balance Sheet for 2016?

7. What is the amount for Net Fixed assets in the Balance Sheet in 2016?

Income Statement year ending 2016 Sales Revenues Cost of goods sold Fixed costs Selling, general, and administrative expenses Depreciation EBIT S500 355 60 25 20 Taxable Income Taxes Net Income *** Tax rate: Dividens paid: 20% S6 15 ASSETS Current Assets Cash Accounts receivable Inventories Total current assets 10 17 Partial Balance Sheet 12/31/2015 LIABILITIES Current Liabilities $ Notes payable 25 Accounts payable 25 Total current liabilities Long-term debt Total Liabilities OWNERS' EQUITY 100 Retained earnings (1) 118 Gross Fixed assets Accumulated depreciation Net Fixed assets Intangible assets 60 200 Common stock 0 Total owner's equity TOTAL ASSETS TOTAL LIABILITIES & OWNER'S EQUITY (1) These are cumulative retained earnings but textbook simply calls it retained earnings S 20 20 ASSETS Current Assets Cash Accounts receivable Inventories Total current assets Gross Fixed assets Accumulated depreciation Net Fixed Assets Intangible assets Total long-term assets Partial Balance Sheet 12/31/2016 LIABILITIES Current Liabilities $ 2 Notes payable 201 Accounts payable 28 Total current liabilities Long-term debt Total liabilities OWNERS' EQUITY Retained earnings 0 Common stock Total owner's equity 54 200 286 TOTAL ASSETS TOTAL LIABILITIES & OWNER'S EQUITY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts