Question: QUESTION 20 Septer Idel Stores has experienced an increase in sales of about 22% during the past year relative to last year. While this is

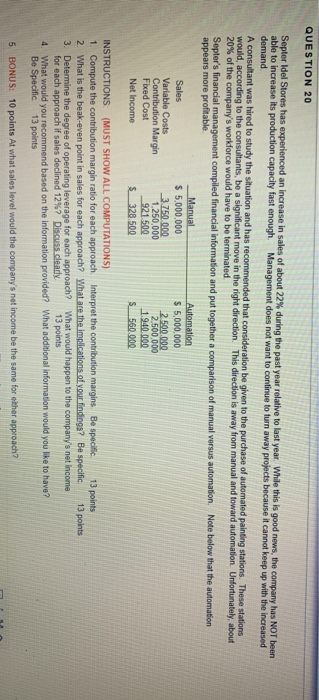

QUESTION 20 Septer Idel Stores has experienced an increase in sales of about 22% during the past year relative to last year. While this is good news, the company has NOT been able to increase its production capacity fast enough Management does not want to continue to turn away projects because it cannot keep up with the increased demand A consultant was hired to study the situation and has recommended that consideration be given to the purchase of automated painting stations. These stations would, according to the consultants, be a significant move in the right direction. This direction is away from manual and toward automation. Unfortunately, about 20% of the company's workforce would have to be terminated Septer's financial management compiled financial information and put together a comparison of manual versus automation Note below that the automation appears more profitable Manual Automation Sales $ 5,000,000 $ 5,000,000 Variable Costs 3.750.000 2.500.000 Contribution Margin 1,250,000 2.500.000 Fixed Cost 921.500 1.940.000 Net Income $_328.500 S560.000 INSTRUCTIONS (MUST SHOW ALL COMPUTATIONS) 1. Compute the contribution margin ratio for each approach interpret the contribution margins. Be specific 13 points 2. What is the beak-even point in sales for each approach? What are the implications of your findinga? Be specific 13 points 3. Determine the degree of operating leverage for each approach? What would happen to the company's net income for each approach if sales declined 12%? Discuss clearly 13 points 4 What would you recommend based on the information provided? What additional information would you like to have? Be Specific 13 points 5 BONUS: 10 points At what sales level would the company's net income be the same for other approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts