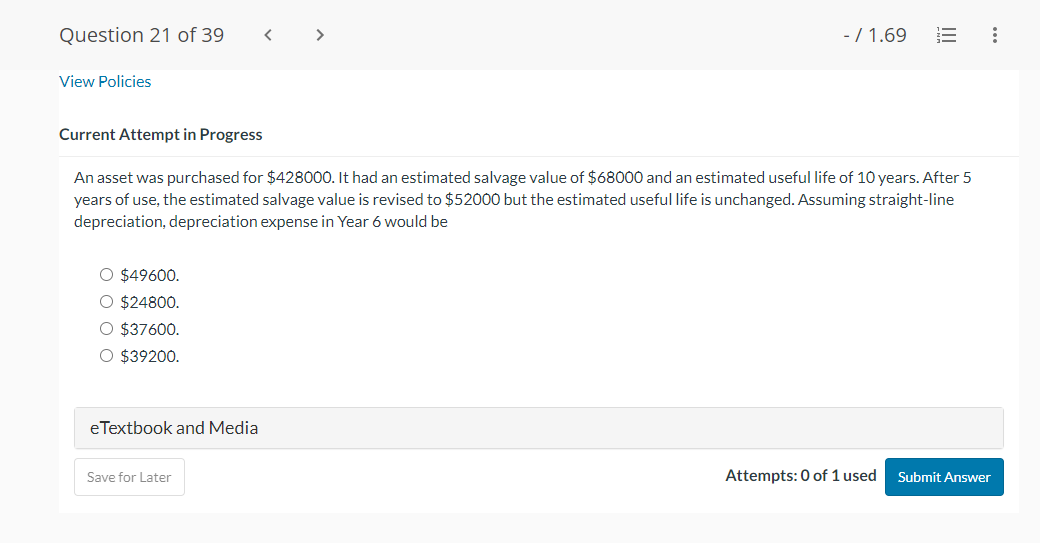

Question: Question 21 01'39 41.69 E View Policies Current Attempt in Progress An asset was purchased for $428000. It had an estimated salvage value of $68000

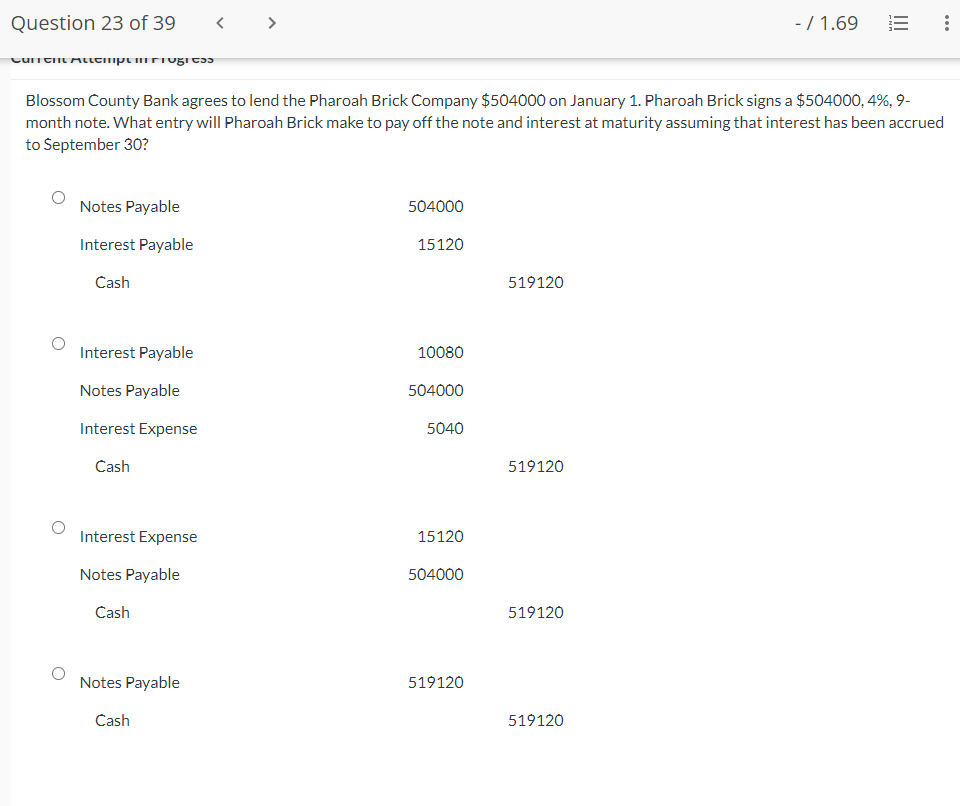

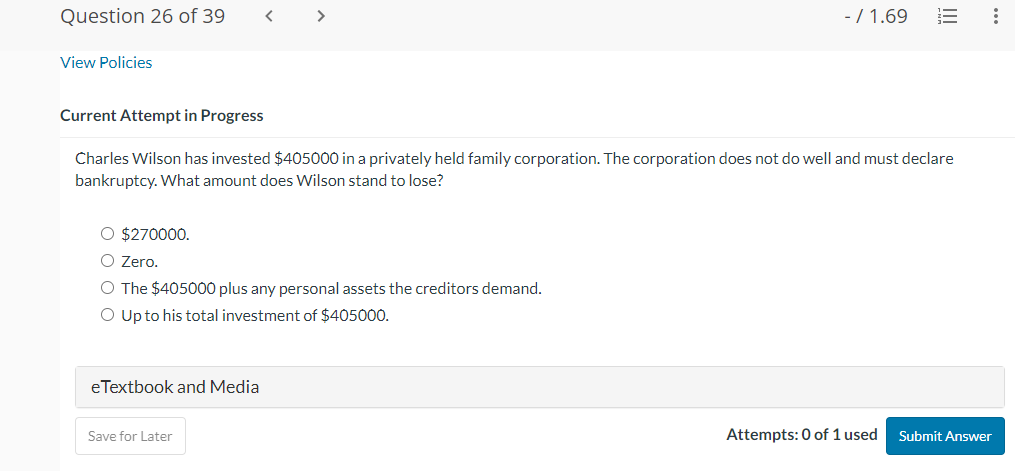

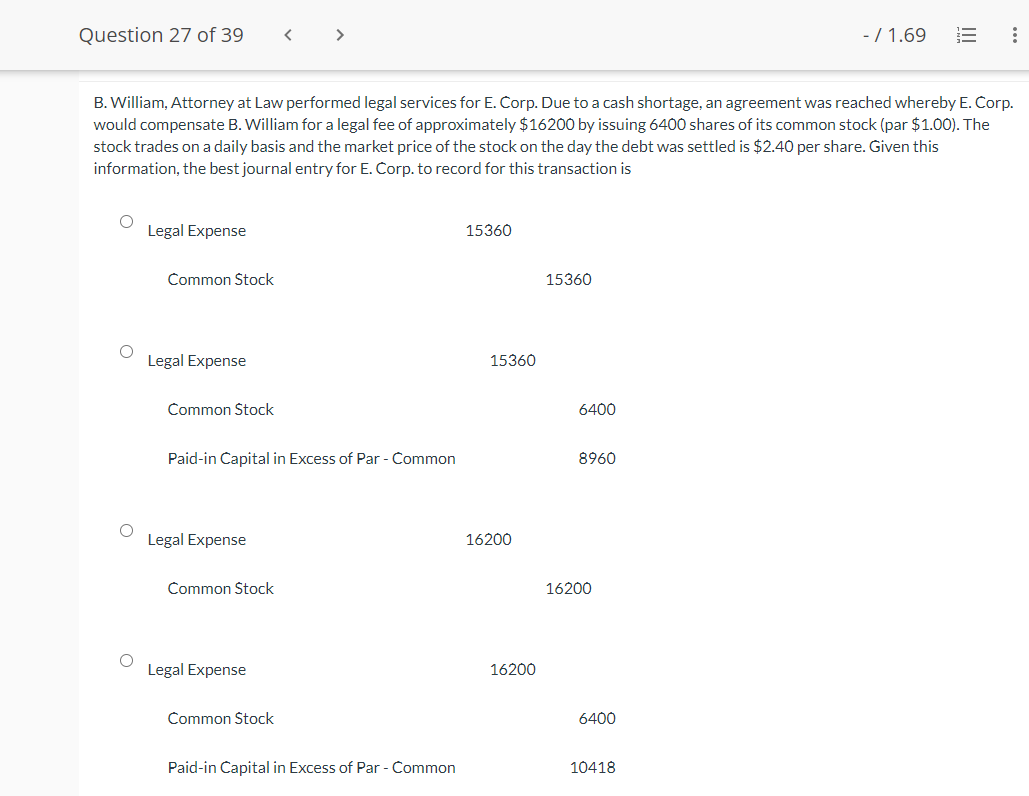

Question 21 01'39 41.69 E View Policies Current Attempt in Progress An asset was purchased for $428000. It had an estimated salvage value of $68000 and an estimated useful life of10years.Af'ter 5 years of use, the estimated salvage value is revised to $52000 but the estimated useful life is unchanged. Assuming straightline depreciation, depreciation expense in 'Y'ear 6 would be 0 $49600 O $24800. O $37600. O $39200. eTextbook and Media Save for Later Attempts: 0 of 1 used Question 23 of 39 11.69 E View Policies Current Attempt in Progress Charles Wilson has invested $405000 in a privately held family corporation. The corporation does not do well and must declare bankruptcy. What amount does Wilson stand to lose? 0 $270000. 0 Zero. 0 The $405000 plus any personal assets the creditors demand. 0 Up to his total investment of $405000. eTextbook and Media Save for Later Attempts: 0 of 1 used Question 27 of 39 {1.69 E 9.9 E. William, Attorney at Lax-i.r performed legal services for E. Corp. Due to a cash shortage, an agreement was reached whereby E. Corp. would compensate B. William for a legal fee of approximately $16200 by issuing 6400 shares of its common stock (par $1.00). The stock trades on a daily basis and the market price otthe stock on the day the debt was settled is $2.40 per share. Given this information, the best jou rnal entryfor E. Corp. to record for this transaction is 0 Legal Expense 15360 Common Stock 15360 O Legal Expense 15360 Common Stock 6400 Paidin Capital in Excess of Par Common 8960 O Legal Expense 16200 Common Stock 16200 0 Legal Expense 16200 Common Stock 6400 Paidin Capital in Excess of Par Common 10418

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts