Question: Question 21 (1 point) A portfolio manager notes that equities are now too large a percentage of his portfolio, based on his asset allocation strategy.

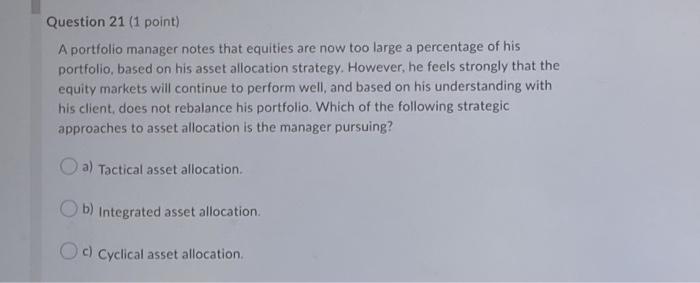

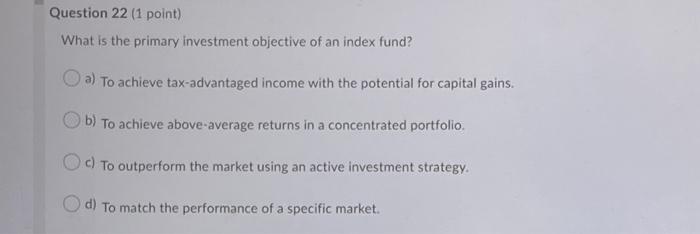

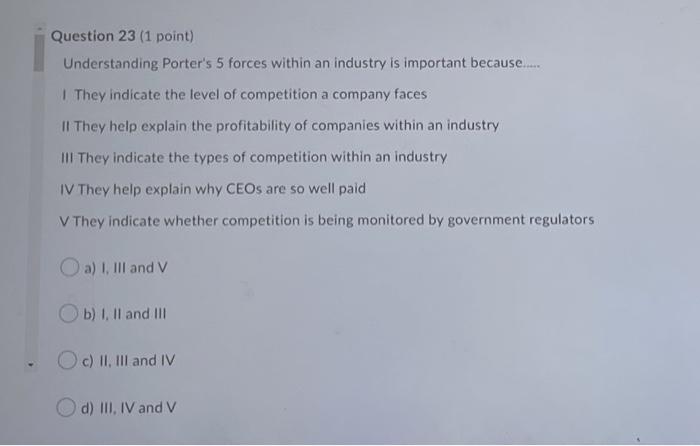

Question 21 (1 point) A portfolio manager notes that equities are now too large a percentage of his portfolio, based on his asset allocation strategy. However, he feels strongly that the equity markets will continue to perform well, and based on his understanding with his client does not rebalance his portfolio. Which of the following strategic approaches to asset allocation is the manager pursuing? a) Tactical asset allocation. b) Integrated asset allocation. Oc) Cyclical asset allocation. Question 22 (1 point) What is the primary investment objective of an index fund? Oa) To achieve tax-advantaged income with the potential for capital gains. b) To achieve above-average returns in a concentrated portfolio Oc) To outperform the market using an active investment strategy. d) To match the performance of a specific market. Question 23 (1 point) Understanding Porter's 5 forces within an industry is important because.... They indicate the level of competition a company faces Il They help explain the profitability of companies within an industry III They indicate the types of competition within an industry IV They help explain why CEOs are so well paid V They indicate whether competition is being monitored by government regulators Oa) 1. Ill and V b) 1. ll and I Oc) II. III and IV d) III, IV and V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts