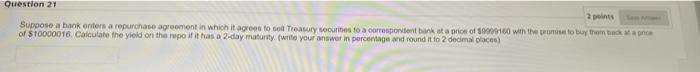

Question: Question 21 2 points Suppose a bank enters a repurchase agreement in which it agrees to sell Treasury securities to a correspondent bank at a

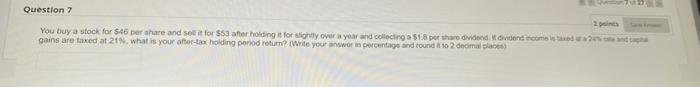

Question 21 2 points Suppose a bank enters a repurchase agreement in which it agrees to sell Treasury securities to a correspondent bank at a price of $0000160 with the promise to buy them back at a price of $10000016. Calculate the yield on the repo if it has a 2-day maturity (write your answer in percentage and round it to 2 decimal places) Question 7 2 points You buy a stock for $46 per share and sell it for $53 after holding it for slightly over a year and collecting a $1.8 per share dividend. It dividend income is taxed at a 24% ce and c gains are taxed at 21%, what is your after-tax holding period return? (Write your answer in percentage and round it to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts