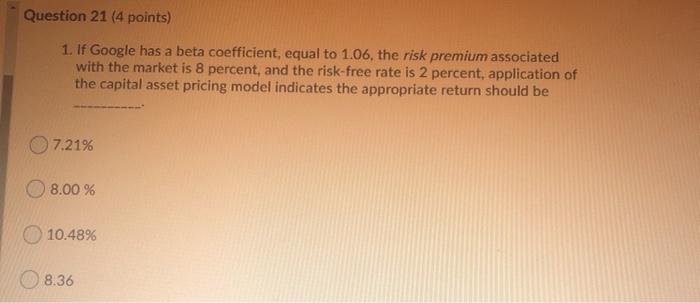

Question: Question 21 (4 points) 1. If Google has a beta coefficient, equal to 1.06, the risk premium associated with the market is 8 percent, and

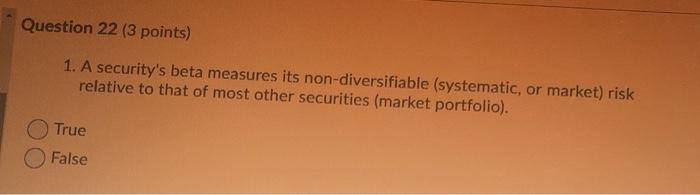

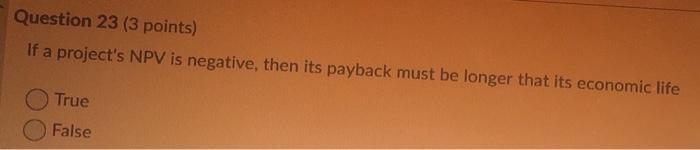

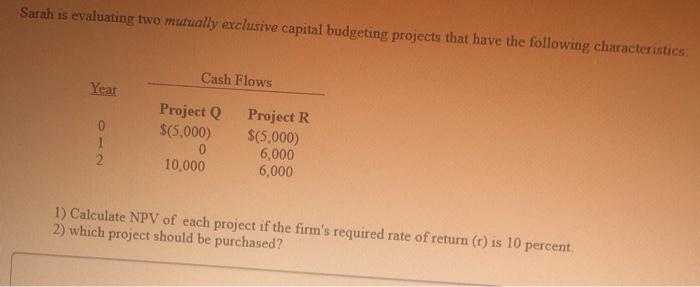

Question 21 (4 points) 1. If Google has a beta coefficient, equal to 1.06, the risk premium associated with the market is 8 percent, and the risk-free rate is 2 percent, application of the capital asset pricing model indicates the appropriate return should be 7.21% 8.00% 10.48% 8.36 Question 22 (3 points) 1. A security's beta measures its non-diversifiable (systematic, or market) risk relative to that of most other securities (market portfolio). True False Question 23 (3 points) If a project's NPV is negative, then its payback must be longer that its economic life True False Sarah is evaluating two mutually exclusive capital budgeting projects that have the following characteristics Cash Flows Year 0 1 2 Project $(5,000) 0 10,000 Project R $(5,000) 6,000 6,000 1) Calculate NPV of each project if the firm's required rate of return (1) is 10 percent 2) which project should be purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts