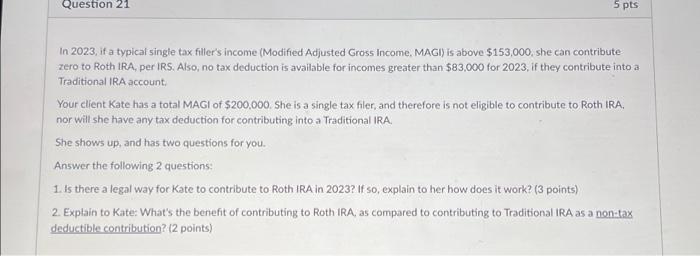

Question: Question 21 5 pts In 2023, if a typical single tax filler's income (Modified Adjusted Gross Income, MAGI) is above $153,000, she can contribute zero

In 2023, if a typical single tax filler's income (Modified Adjusted Gross Income, MAGI) is above $153,000, she can contribute zero to Roth IRA, per IRS. Also, no tax deduction is avallable for incomes greater than $83,000 for 2023 , if they contribute into a Traditional IRA account: Your elient Kate has a total MAGI of $200,000. She is a single tax filer, and therefore is not eligible to contribute to Roth IRA, nor will she have any tax deduction for contributing into a Traditional IRA. She shows up, and has two questions for you. Answer the following 2 questions: 1. Is there a legal way for Kate to contribute to Roth IRA in 2023? If so, explain to her how does it work? (3 points) 2. Explain to Kate: What's the benefit of contributing to Roth IRA, as compared to contributing to Traditional IRA as a non-tax deductible contribution? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts