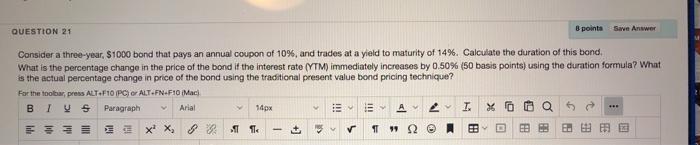

Question: QUESTION 21 8 points on Answer Consider a three-year $1000 bond that pays an annual coupon of 10%, and trades at a yield to maturity

QUESTION 21 8 points on Answer Consider a three-year $1000 bond that pays an annual coupon of 10%, and trades at a yield to maturity of 14%. Calculate the duration of this bond, What is the percentage change in the price of the bond if the interest rate (YTM) immediately increases by 0.50% (50 basis points) using the duration formula? What is the actual percentage change in price of the bond using the traditional present value bond pricing technique? For the toolbar, press ALT F10 PC or ALT-FN-F10 (Mac) BI VS Paragraph Arial 14px A T. X GQ 6 x X, + 11 * 12 @ . V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts