Question: QUESTION 21 A site is improved with an old retail building in a neighborhood with several newly built multifamily buildings. If capitalization rates for similar

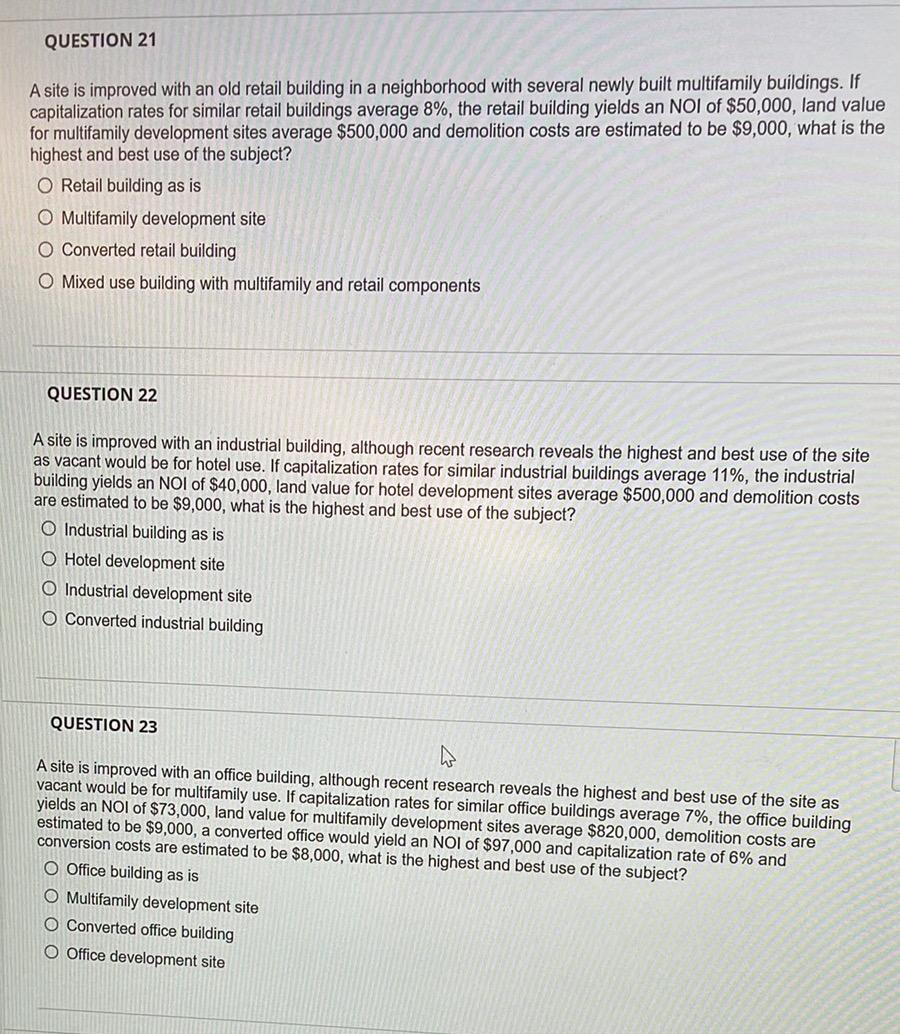

QUESTION 21 A site is improved with an old retail building in a neighborhood with several newly built multifamily buildings. If capitalization rates for similar retail buildings average 8%, the retail building yields an NOI of $50,000, land value for multifamily development sites average $500,000 and demolition costs are estimated to be $9,000, what is the highest and best use of the subject? O Retail building as is O Multifamily development site O Converted retail building O Mixed use building with multifamily and retail components QUESTION 22 A site is improved with an industrial building, although recent research reveals the highest and best use of the site as vacant would be for hotel use. If capitalization rates for similar industrial buildings average 11%, the industrial building yields an NOI of $40,000, land value for hotel development sites average $500,000 and demolition costs are estimated to be $9,000, what is the highest and best use of the subject? O Industrial building as is O Hotel development site O Industrial development site O Converted industrial building QUESTION 23 A site is improved with an office building, although recent research reveals the highest and best use of the site as vacant would be for multifamily use. If capitalization rates for similar office buildings average 7%, the office building yields an NOI of $73,000, land value for multifamily development sites average $820,000, demolition costs are estimated to be $9,000, a converted office would yield an NOI of $97,000 and capitalization rate of 6% and conversion costs are estimated to be $8,000, what is the highest and best use of the subject? O Office building as is O Multifamily development site O Converted office building O Office development site QUESTION 21 A site is improved with an old retail building in a neighborhood with several newly built multifamily buildings. If capitalization rates for similar retail buildings average 8%, the retail building yields an NOI of $50,000, land value for multifamily development sites average $500,000 and demolition costs are estimated to be $9,000, what is the highest and best use of the subject? O Retail building as is O Multifamily development site O Converted retail building O Mixed use building with multifamily and retail components QUESTION 22 A site is improved with an industrial building, although recent research reveals the highest and best use of the site as vacant would be for hotel use. If capitalization rates for similar industrial buildings average 11%, the industrial building yields an NOI of $40,000, land value for hotel development sites average $500,000 and demolition costs are estimated to be $9,000, what is the highest and best use of the subject? O Industrial building as is O Hotel development site O Industrial development site O Converted industrial building QUESTION 23 A site is improved with an office building, although recent research reveals the highest and best use of the site as vacant would be for multifamily use. If capitalization rates for similar office buildings average 7%, the office building yields an NOI of $73,000, land value for multifamily development sites average $820,000, demolition costs are estimated to be $9,000, a converted office would yield an NOI of $97,000 and capitalization rate of 6% and conversion costs are estimated to be $8,000, what is the highest and best use of the subject? O Office building as is O Multifamily development site O Converted office building O Office development site

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts