Question: QUESTION 21 As an asset's beta coefficient decreases, its expected return: does not change increases. decreases. QUESTION 22 Sometimes, the option to abandon or expand

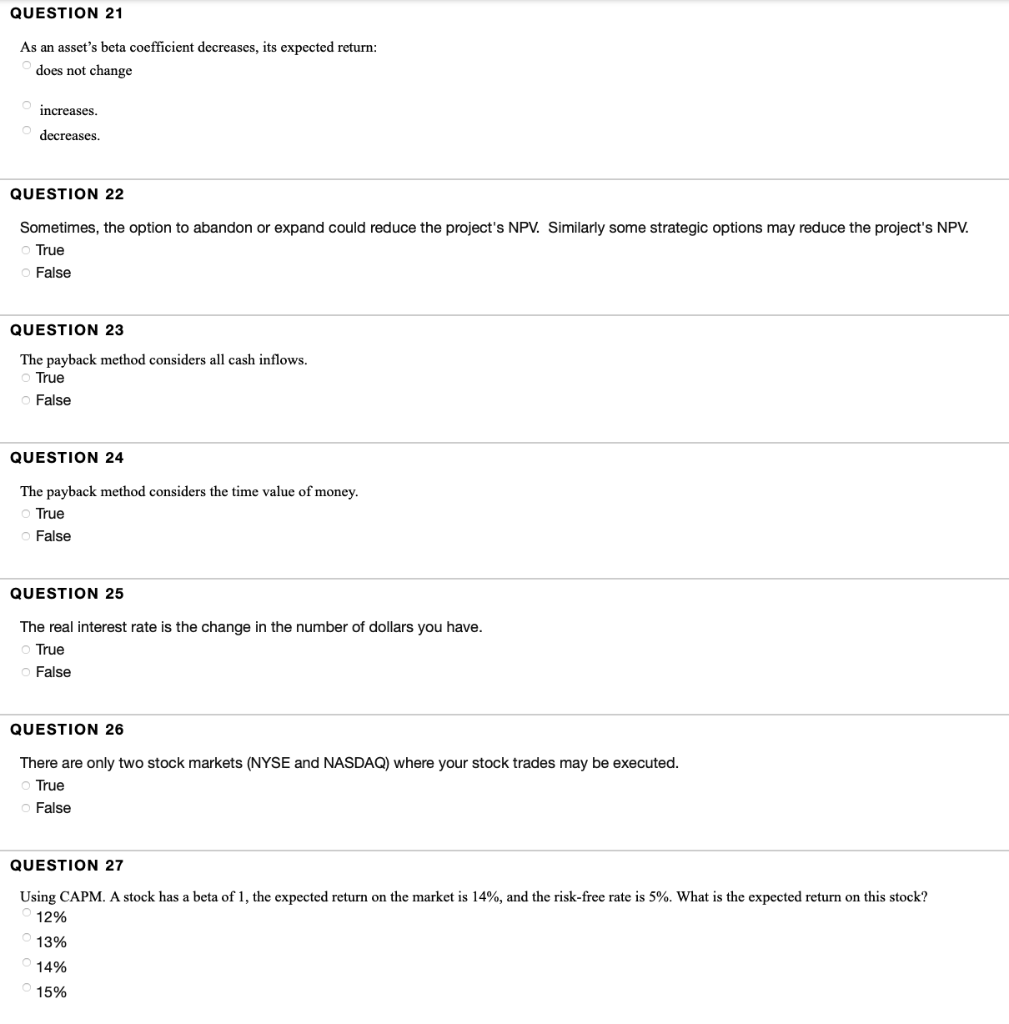

QUESTION 21 As an asset's beta coefficient decreases, its expected return: does not change increases. decreases. QUESTION 22 Sometimes, the option to abandon or expand could reduce the project's NPV. Similarly some strategic options may reduce the project's NPV. True False QUESTION 23 The payback method considers all cash inflows. True False QUESTION 24 The payback method considers the time value of money. True False QUESTION 25 The real interest rate is the change in the number of dollars you have. True False QUESTION 26 There are only two stock markets (NYSE and NASDAQ) where your stock trades may be executed. True False QUESTION 27 Using CAPM. A stock has a beta of 1, the expected return on the market is 14%, and the risk-free rate is 5%. What is the expected return on this stock? 12% 13% 14% 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts