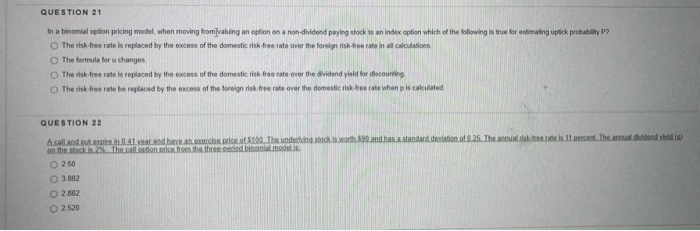

Question: QUESTION 21 In a binomial option pricing model, when moving from valuing an option on a non-dividend paying stock to an index option which of

QUESTION 21 In a binomial option pricing model, when moving from valuing an option on a non-dividend paying stock to an index option which of the following is true for estimating upfick probability ? The risk free rate is replaced by the excess of the domestic risk free rate over the foreign risk-free rate in all calculations The formula for u changes The risk tree rate is replaced by the excess of the domestic risk-free rate over the dividend yield for discounting The risk free rate be replaced by the excess of the foreign risk free rate over the domestic when pls called QUESTION 22 A call and stare in 41 year and have an arch. 5100. The underwath 590 and has a standard deviation of 0.25. The likes 11 percent. The auldandyolda) on the stocks 2. The collection price from the three ed il models 250 3882 2.882 2520

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts