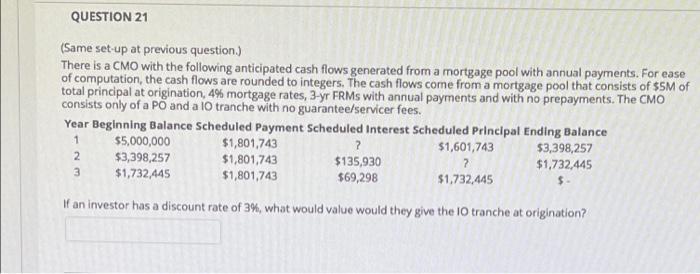

Question: QUESTION 21 (Same set-up at previous question.) There is a CMO with the following anticipated cash flows generated from a mortgage pool with annual payments.

QUESTION 21 (Same set-up at previous question.) There is a CMO with the following anticipated cash flows generated from a mortgage pool with annual payments. For ease of computation, the cash flows are rounded to integers. The cash flows come from a mortgage pool that consists of $5M of total principal at origination, 4% mortgage rates, 3-yr FRMs with annual payments and with no prepayments. The CMO consists only of a Po and a 10 tranche with no guarantee/servicer fees. Year Beginning Balance Scheduled Payment Scheduled Interest Scheduled Principal Ending Balance 1 $5,000,000 $1,801,743 ? $1,601,743 $3,398,257 2 $3,398,257 $1,801,743 $135,930 ? $1,732,445 3 $1,732,445 $1,801,743 $69,298 $1,732,445 $ If an investor has a discount rate of 3%, what would value would they give the 10 tranche at origination? QUESTION 21 (Same set-up at previous question.) There is a CMO with the following anticipated cash flows generated from a mortgage pool with annual payments. For ease of computation, the cash flows are rounded to integers. The cash flows come from a mortgage pool that consists of $5M of total principal at origination, 4% mortgage rates, 3-yr FRMs with annual payments and with no prepayments. The CMO consists only of a Po and a 10 tranche with no guarantee/servicer fees. Year Beginning Balance Scheduled Payment Scheduled Interest Scheduled Principal Ending Balance 1 $5,000,000 $1,801,743 ? $1,601,743 $3,398,257 2 $3,398,257 $1,801,743 $135,930 ? $1,732,445 3 $1,732,445 $1,801,743 $69,298 $1,732,445 $ If an investor has a discount rate of 3%, what would value would they give the 10 tranche at origination

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts