Question: Question 22 (1 point) A newly issue CMO's mortgage pool has a balance of $48.87 million with an average interest rate of 9.97% payable annually

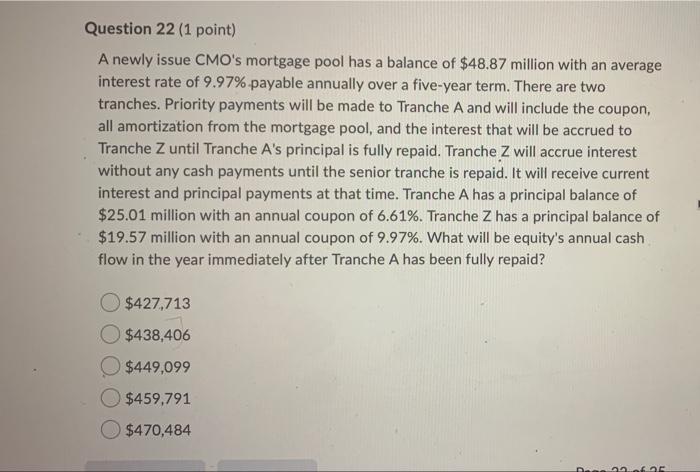

Question 22 (1 point) A newly issue CMO's mortgage pool has a balance of $48.87 million with an average interest rate of 9.97% payable annually over a five-year term. There are two tranches. Priority payments will be made to Tranche A and will include the coupon, all amortization from the mortgage pool, and the interest that will be accrued to Tranche Z until Tranche A's principal is fully repaid. Tranche Z will accrue interest without any cash payments until the senior tranche is repaid. It will receive current interest and principal payments at that time. Tranche A has a principal balance of $25.01 million with an annual coupon of 6.61%. Tranche Z has a principal balance of $19.57 million with an annual coupon of 9.97%. What will be equity's annual cash flow in the year immediately after Tranche A has been fully repaid? $427.713 $438,406 $449,099 $459,791 $470,484 Question 22 (1 point) A newly issue CMO's mortgage pool has a balance of $48.87 million with an average interest rate of 9.97% payable annually over a five-year term. There are two tranches. Priority payments will be made to Tranche A and will include the coupon, all amortization from the mortgage pool, and the interest that will be accrued to Tranche Z until Tranche A's principal is fully repaid. Tranche Z will accrue interest without any cash payments until the senior tranche is repaid. It will receive current interest and principal payments at that time. Tranche A has a principal balance of $25.01 million with an annual coupon of 6.61%. Tranche Z has a principal balance of $19.57 million with an annual coupon of 9.97%. What will be equity's annual cash flow in the year immediately after Tranche A has been fully repaid? $427.713 $438,406 $449,099 $459,791 $470,484

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts