Question: Question 22 (1 point) Your long-range plan is to retire in 40 years, following which you plan on taking a retirement income out of your

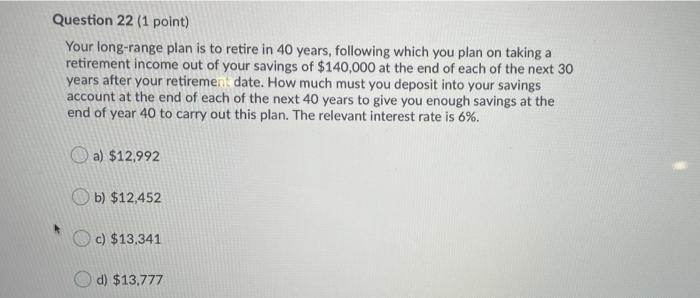

Question 22 (1 point) Your long-range plan is to retire in 40 years, following which you plan on taking a retirement income out of your savings of $140,000 at the end of each of the next 30 years after your retiremen date. How much must you deposit into your savings account at the end of each of the next 40 years to give you enough savings at the end of year 40 to carry out this plan. The relevant interest rate is 6%. a) $12,992 b) $12,452 c) $13,341 d) $13.777

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts