Question: Question 22 3 pts If you are long a future contract You prot and loss were the you benefit when the procent other stove the

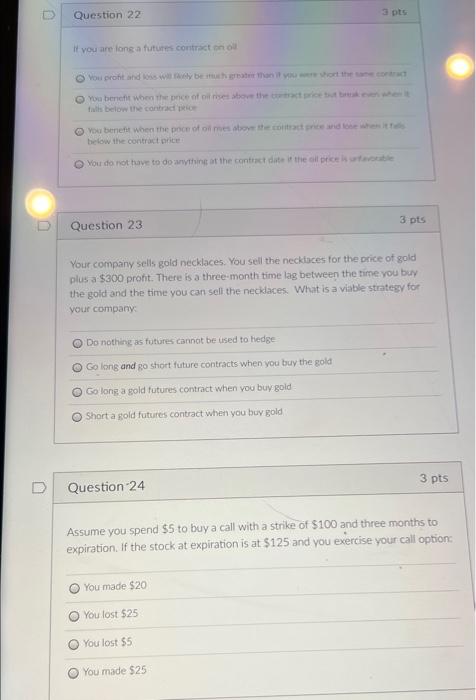

Question 22 3 pts If you are long a future contract You prot and loss were the you benefit when the procent other stove the contract price that brokenwald tils below the contra You beneft when the poon of ollmes above the contract price and to when it rate below the contractice You do not have to do anything of the contract date the price 3 pts Question 23 Your company sells gold necklaces. You sell the necklaces for the price of gold plus a $300 proht. There is a three month time lag between the time you buy the gold and the time you can sell the necklaces. What is a viable strategy for your company Do nothing as futures cannot be used to hedge O Go long and go short future contracts when you buy the gold Golong a gold futures contract when you buy gold Short a gold futures contract when you buy gold 3 pts D Question 24 Assume you spend $5 to buy a call with a strike of $100 and three months to expiration. If the stock at expiration is at $125 and you exercise your call option: You made $20 You lost $25 You lost $5 You made $25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts