Question: Question 22 4 pts The alternative minimum tax was designed to make sure that low-income people don't take advantage of too many special tax rules

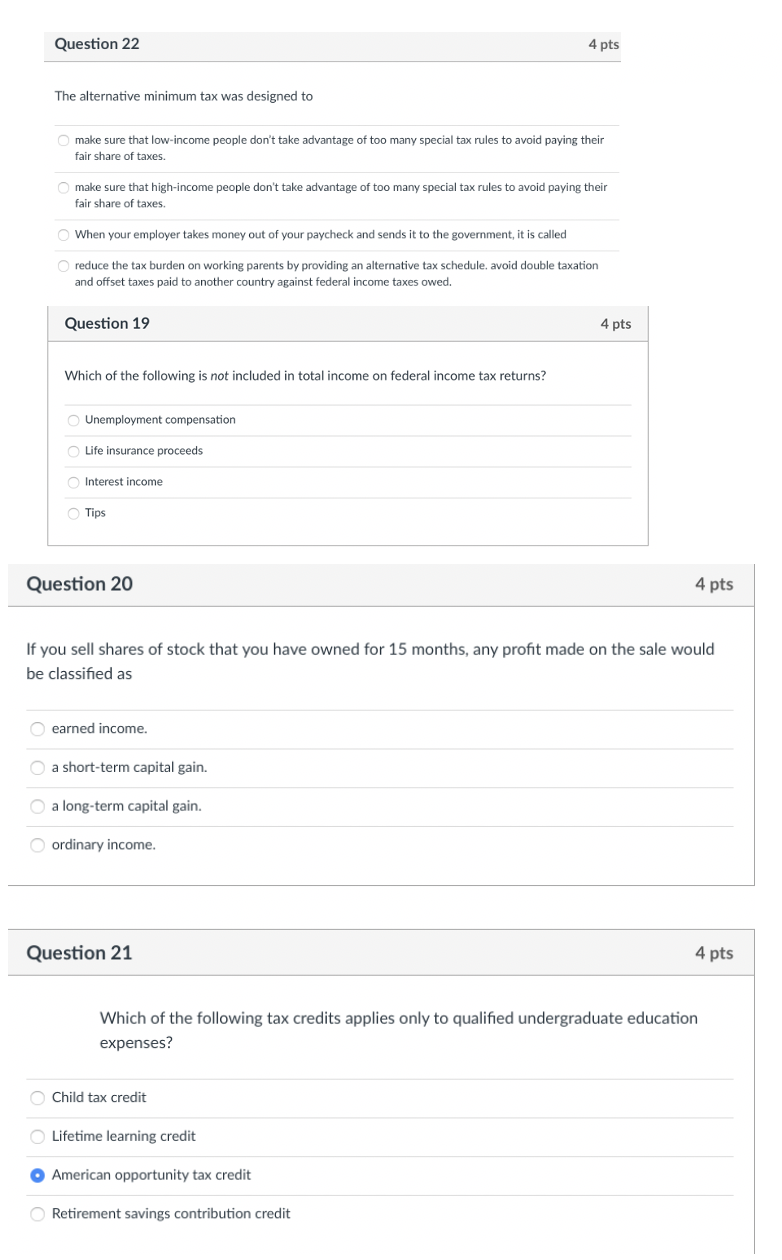

Question 22 4 pts The alternative minimum tax was designed to make sure that low-income people don't take advantage of too many special tax rules to avoid paying their fair share of taxes. make sure that high-income people don't take advantage of too many special tax rules to avoid paying their fair share of taxes. When your employer takes money out of your paycheck and sends it to the government, it is called reduce the tax burden on working parents by providing an alternative tax schedule, avoid double taxation and offset taxes paid to another country against federal income taxes owed. Question 19 4 pts Which of the following is not included in total income on federal income tax returns? Unemployment compensation Life insurance proceeds Interest income Tips Question 20 4 pts If you sell shares of stock that you have owned for 15 months, any profit made on the sale would be classified as earned income. a short-term capital gain. a long-term capital gain. ordinary income. Question 21 4 pts Which of the following tax credits applies only to qualified undergraduate education expenses? Child tax credit Lifetime learning credit American opportunity tax credit Retirement savings contribution credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts