Question: QUESTION 22 In determining the cash flows from operating activities for the statement of cash flows by the indirect method, the depreciation expense for the

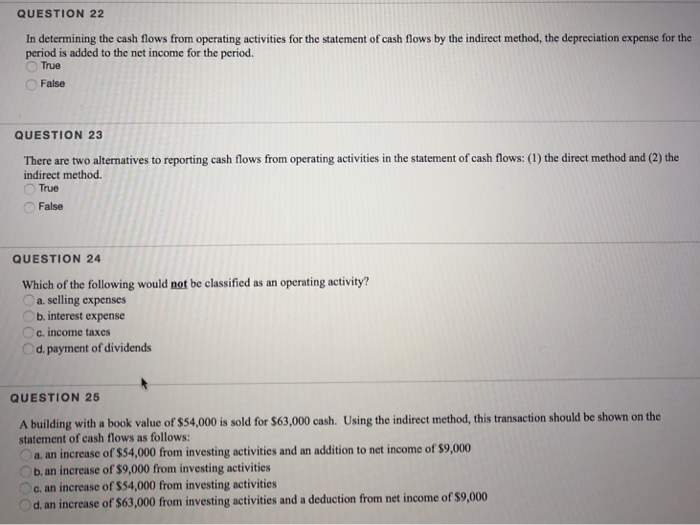

QUESTION 22 In determining the cash flows from operating activities for the statement of cash flows by the indirect method, the depreciation expense for the period is added to the net income for the period. True False QUESTION 23 There are two alternatives to reporting cash flows from operating activities in the statement of cash flows: (1) the direct method and (2) the indirect method. True False QUESTION 24 Which of the following would not be classified as an operating activity? a. selling expenses b. interest expense c. income taxes d. payment of dividends QUESTION 25 A building with a book value of $$4,000 is sold for $63,000 cash. Using the indirect method, this transaction should be shown on the statement of cash flows as follows: a. an increase of $54,000 from investing activities and an addition to net income of $9,000 b. an increase of $9,000 from investing activities c. an increase of $54,000 from investing activities d an increase of $63,000 from investing activities and a deduction from net income of $9,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts