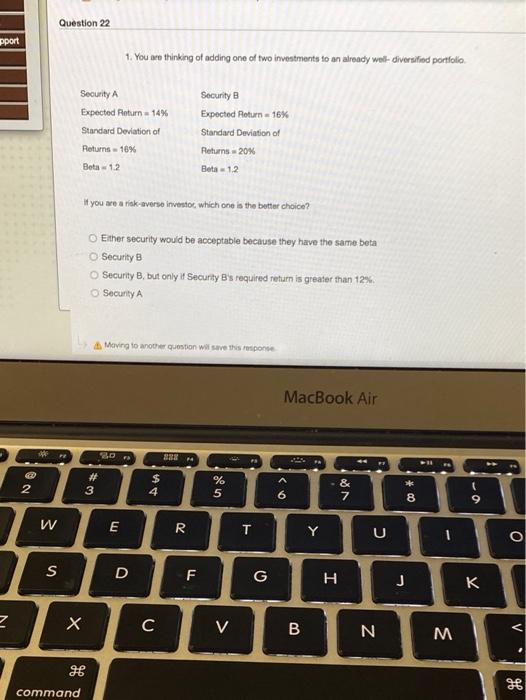

Question: Question 22 pport 1. You are thinking of adding one of two investments to an already well-diversified portfolio Security A Expected Return = 14% Standard

Question 22 pport 1. You are thinking of adding one of two investments to an already well-diversified portfolio Security A Expected Return = 14% Standard Deviation of Returns - 10% Beta 1.2 Security Expected Roturn = 16% Standard Deviation of Returns 20% Beta 1.2 If you are a risk-averse investor which one is the better choice? Either security would be acceptable because they have the same beta Security B Security B, but only if Security B's required return is greater than 12% Security Moving to another question will save this response MacBook Air F So # 3 2 $ 4 % 5 6 & 7 8 9 W E R T Y U 0 S D G H J 2 C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock