Question: Question 22 Problem 2 80 points Katy Company (KO) is selling for $47and has the following six-month options outstanding. Strike Price Option Market Price Call

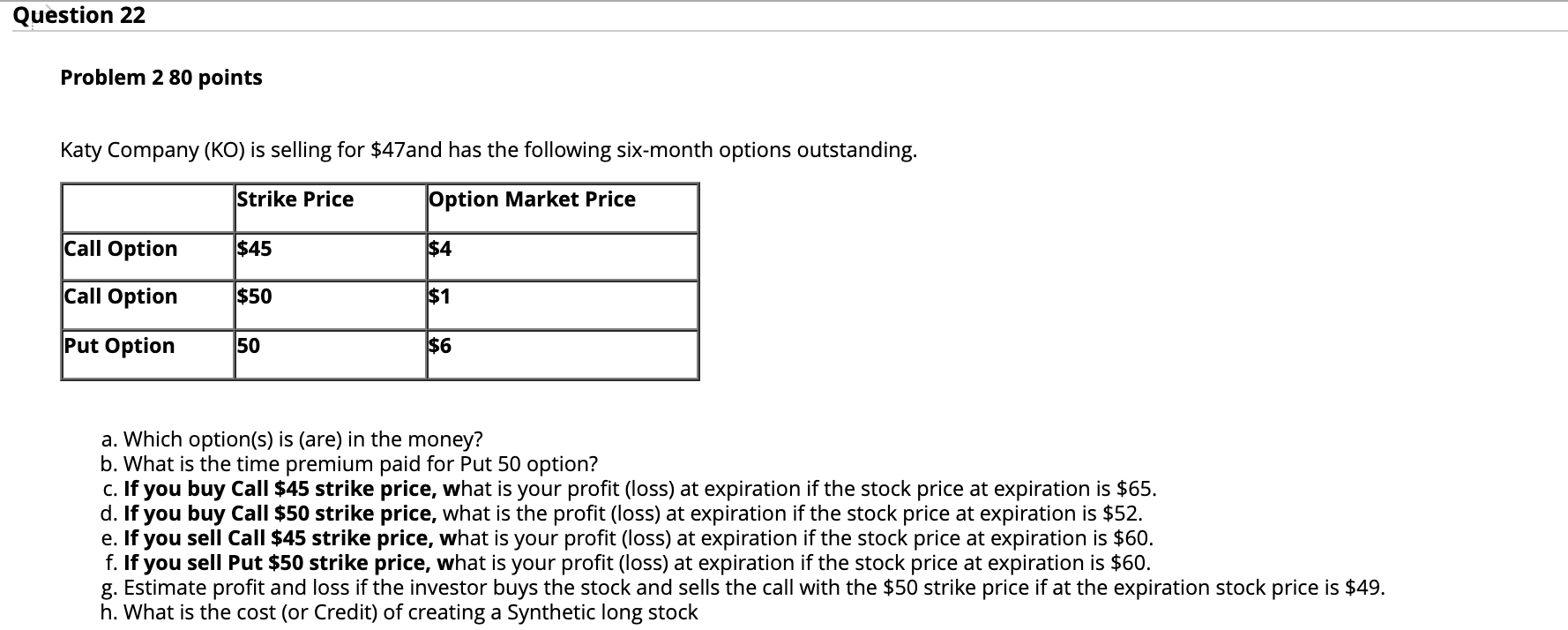

Question 22 Problem 2 80 points Katy Company (KO) is selling for $47and has the following six-month options outstanding. Strike Price Option Market Price Call Option $45 $4 Call Option $50 $1 Put Option 50 $6 a. Which option(s) is (are) in the money? b. What is the time premium paid for Put 50 option? c. If you buy Call $45 strike price, what is your profit (loss) at expiration if the stock price at expiration is $65. d. If you buy Call $50 strike price, what is the profit (loss) at expiration if the stock price at expiration is $52. e. If you sell Call $45 strike price, what is your profit (loss) at expiration if the stock price at expiration is $60. f. If you sell Put $50 strike price, what is your profit (loss) at expiration if the stock price at expiration is $60. g. Estimate profit and loss if the investor buys the stock and sells the call with the $50 strike price if at the expiration stock price is $49. h. What is the cost (or Credit) of creating a Synthetic long stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts