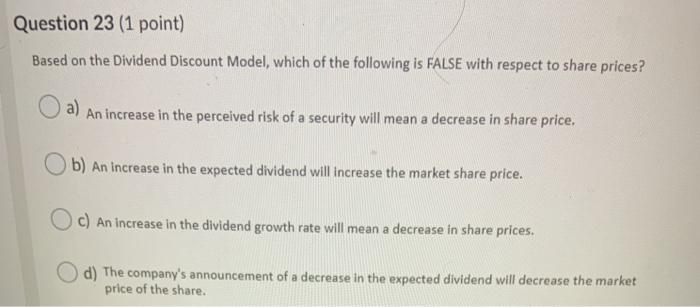

Question: Question 23 (1 point) Based on the Dividend Discount Model, which of the following is FALSE with respect to share prices? a) An increase in

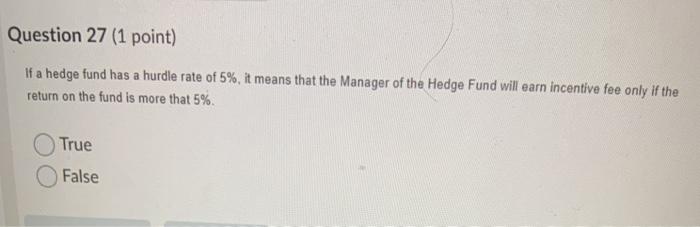

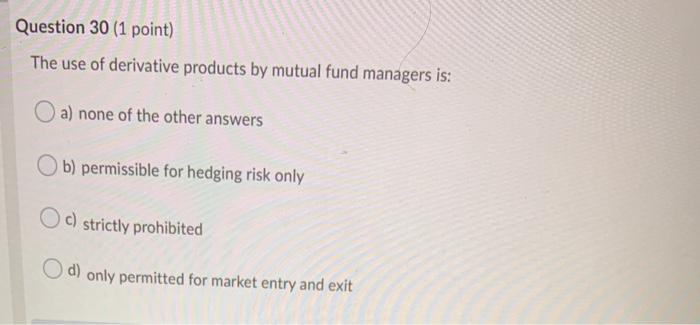

Question 23 (1 point) Based on the Dividend Discount Model, which of the following is FALSE with respect to share prices? a) An increase in the perceived risk of a security will mean a decrease in share price, b) An increase in the expected dividend will increase the market share price. Oc) An increase in the dividend growth rate will mean a decrease in share prices. O d) The company's announcement of a decrease in the expected dividend will decrease the market price of the share. Question 27 (1 point) If a hedge fund has a hurdle rate of 5%, it means that the Manager of the Hedge Fund will earn incentive fee only if the return on the fund is more that 5%. True False Question 30 (1 point) The use of derivative products by mutual fund managers is: a) none of the other answers Ob) permissible for hedging risk only Oc) strictly prohibited Od) only permitted for market entry and exit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts