Question: Question 23 (1 point) XYZ Inc set up and started a mining operation on April 1 at a cost of $10,140,100. The company is legally

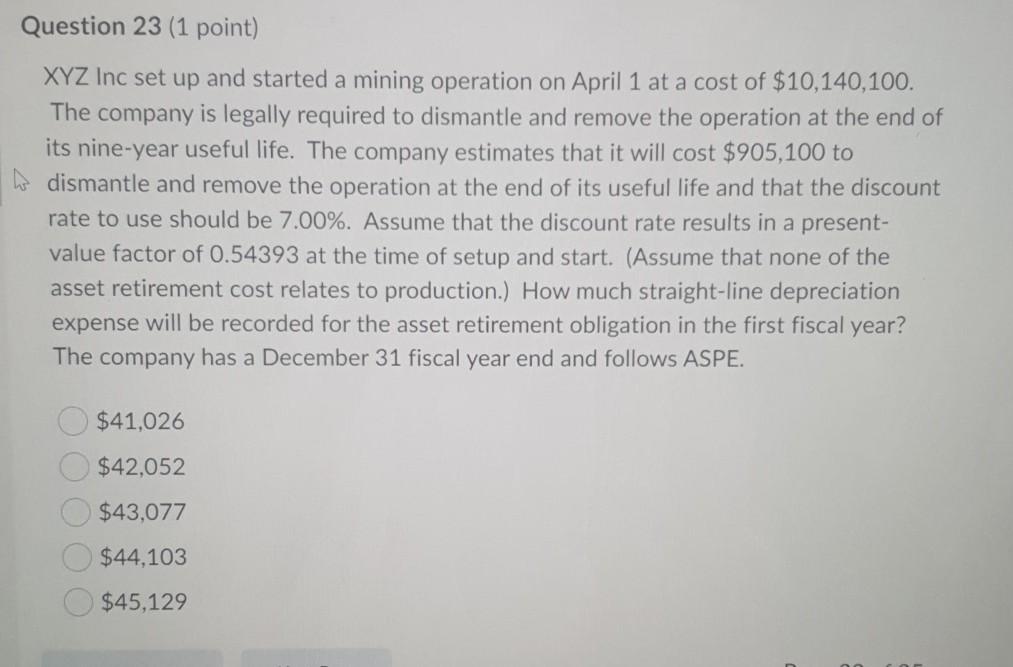

Question 23 (1 point) XYZ Inc set up and started a mining operation on April 1 at a cost of $10,140,100. The company is legally required to dismantle and remove the operation at the end of its nine-year useful life. The company estimates that it will cost $905,100 to We dismantle and remove the operation at the end of its useful life and that the discount rate to use should be 7.00%. Assume that the discount rate results in a present- value factor of 0.54393 at the time of setup and start. (Assume that none of the asset retirement cost relates to production.) How much straight-line depreciation expense will be recorded for the asset retirement obligation in the first fiscal year? The company has a December 31 fiscal year end and follows ASPE. $41,026 $42,052 $43,077 $44,103 $45,129

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts