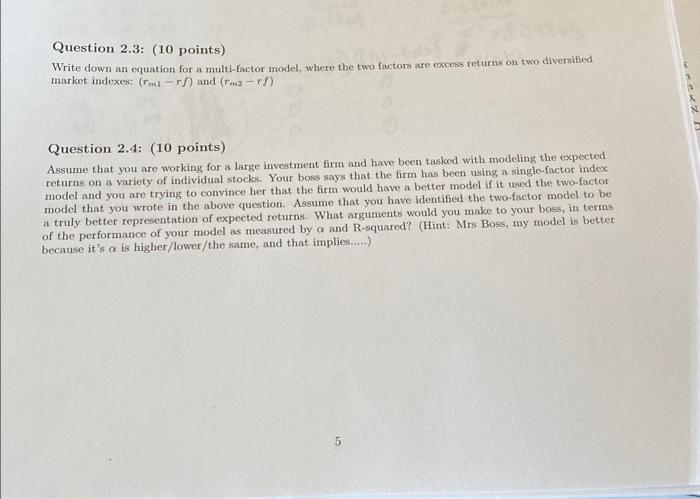

Question: Question 2.3: (10 points) Write down an equation for a multi-factor model, where the two factors are excess returns on two diversified market indexes: (mi-r/)

Question 2.3: (10 points) Write down an equation for a multi-factor model, where the two factors are excess returns on two diversified market indexes: (mi-r/) and (rm2-r 4 Question 2.4: (10 points) Assume that you are working for a large investment firm and have been tasked with modeling the expected returns on a variety of individual stocks. Your boss says that the firm has been using a single-factor index model and you are trying to convince her that the firm would have a better model if it used the two-factor model that you wrote in the above question. Assume that you have identified the two-factor model to be a truly better representation of expected returns. What arguments would you make to your boss, in terms of the performance of your model as measured by a and R-squared? (Hint: Mrs Boss, my model is better because it's a is higher/lower/the same, and that implies.....) 5 Question 2.3: (10 points) Write down an equation for a multi-factor model, where the two factors are excess returns on two diversified market indexes: (mi-r/) and (rm2-r 4 Question 2.4: (10 points) Assume that you are working for a large investment firm and have been tasked with modeling the expected returns on a variety of individual stocks. Your boss says that the firm has been using a single-factor index model and you are trying to convince her that the firm would have a better model if it used the two-factor model that you wrote in the above question. Assume that you have identified the two-factor model to be a truly better representation of expected returns. What arguments would you make to your boss, in terms of the performance of your model as measured by a and R-squared? (Hint: Mrs Boss, my model is better because it's a is higher/lower/the same, and that implies.....) 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts