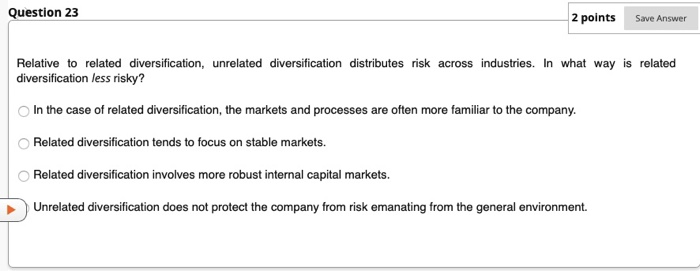

Question: Question 23 2 points Save Answer Relative to related diversification, unrelated diversification distributes risk across industries. In what way is related diversification less risky? In

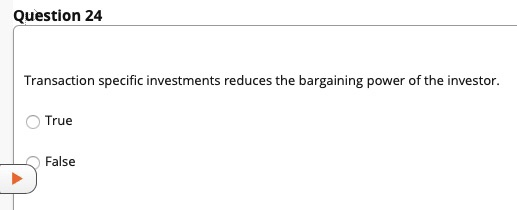

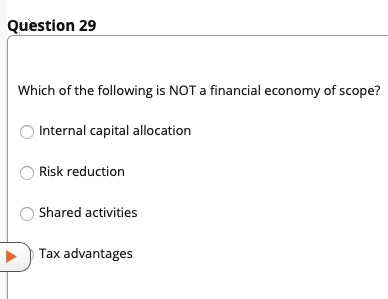

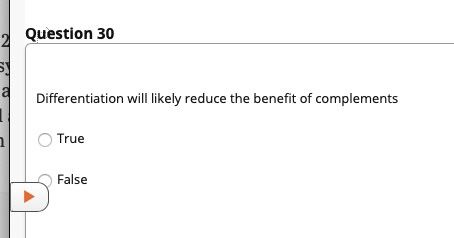

Question 23 2 points Save Answer Relative to related diversification, unrelated diversification distributes risk across industries. In what way is related diversification less risky? In the case of related diversification, the markets and processes are often more familiar to the company. Related diversification tends to focus on stable markets. Related diversification involves more robust internal capital markets. Unrelated diversification does not protect the company from risk emanating from the general environment. Question 24 Transaction specific investments reduces the bargaining power of the investor. True False Question 29 Which of the following is NOT a financial economy of scope? Internal capital allocation Risk reduction Shared activities Tax advantages Question 30 Differentiation will likely reduce the benefit of complements True False Question 31 When is opportunism least likely to be a problem? When there are many suppliers When the industry is new When there are many complements When the industry is mature

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts