Question: Question 23 (2.2 points) Listen Up until three years ago, A.C. Dime opened an average of 10 new retail stores a year. One of every

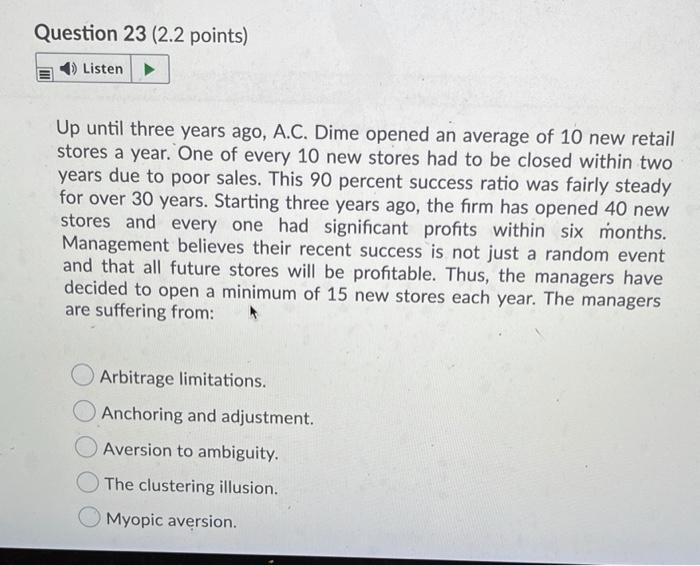

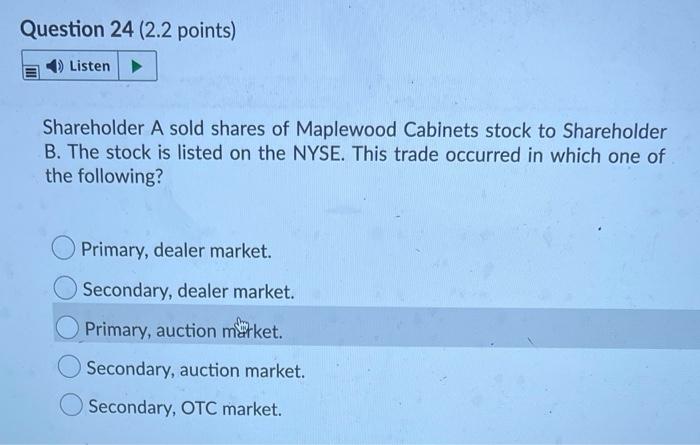

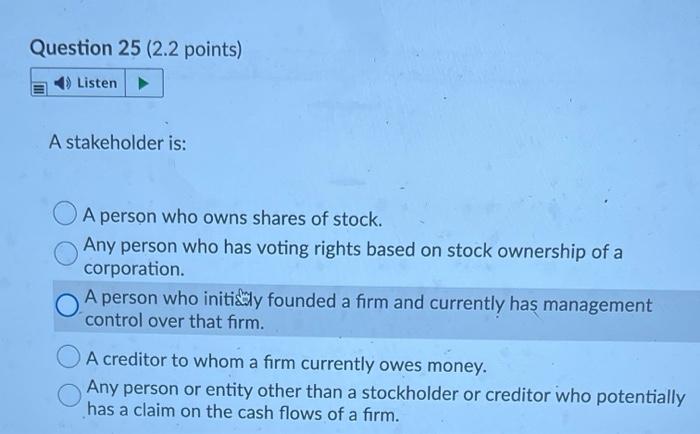

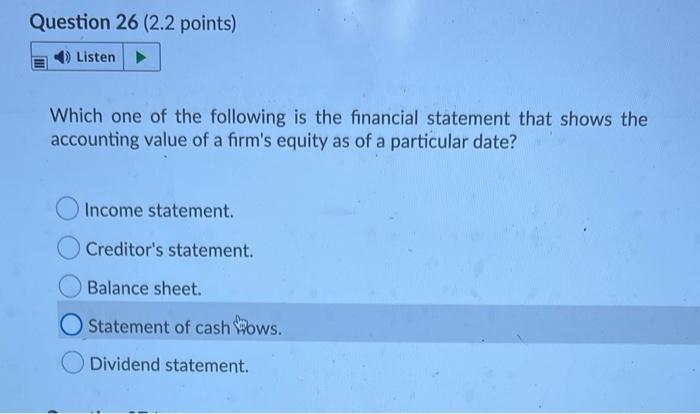

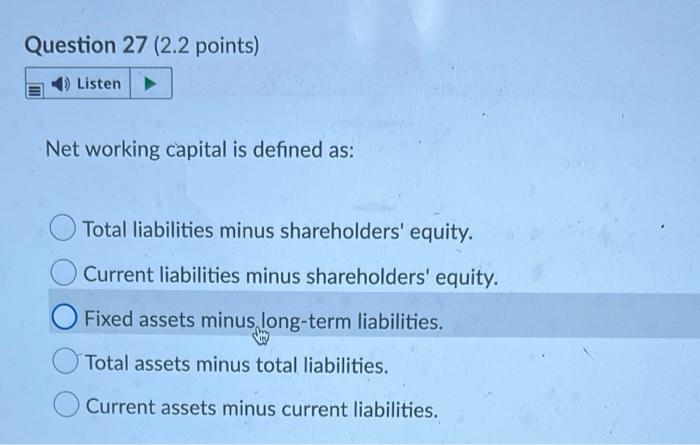

Question 23 (2.2 points) Listen Up until three years ago, A.C. Dime opened an average of 10 new retail stores a year. One of every 10 new stores had to be closed within two years due to poor sales. This 90 percent success ratio was fairly steady for over 30 years. Starting three years ago, the firm has opened 40 new stores and everyone had significant profits within six months. Management believes their recent success not just a random event and that all future stores will be profitable. Thus, the managers have decided to open a minimum of 15 new stores each year. The managers are suffering from: Arbitrage limitations. Anchoring and adjustment. Aversion to ambiguity. The clustering illusion. Myopic aversion. Question 24 (2.2 points) Listen Shareholder A sold shares of Maplewood Cabinets stock to Shareholder B. The stock is listed on the NYSE. This trade occurred in which one of the following? Primary, dealer market. Secondary, dealer market. Primary, auction market. Secondary, auction market. Secondary, OTC market. Question 25 (2.2 points) Listen A stakeholder is: A person who owns shares of stock. Any person who has voting rights based on stock ownership of a corporation. A person who initially founded a firm and currently has management control over that firm. A creditor to whom a firm currently owes money. Any person or entity other than a stockholder or creditor who potentially has a claim on the cash flows of a firm. Question 26 (2.2 points) Listen Which one of the following is the financial statement that shows the accounting value of a firm's equity as of a particular date? Income statement. Creditor's statement. Balance sheet. Statement of cash Shows. Dividend statement. Question 27 (2.2 points) Listen Net working capital is defined as: Total liabilities minus shareholders' equity. Current liabilities minus shareholders' equity. Fixed assets minus long-term liabilities. Total assets minus total liabilities. Current assets minus current liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts