Question: Question 23 (3 points) You financed a project with 24% debt and (100-24% equity. Your initial investment is $31,000, while you expected cash flow one

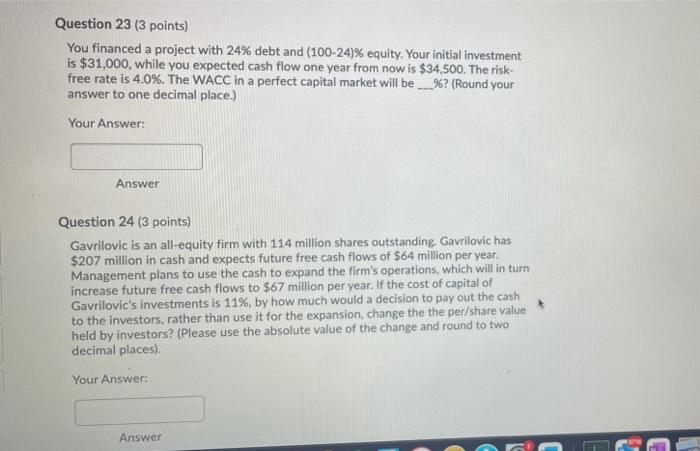

Question 23 (3 points) You financed a project with 24% debt and (100-24% equity. Your initial investment is $31,000, while you expected cash flow one year from now is $34,500. The risk- free rate is 4.0%. The WACC in a perfect capital market will be ___ %? (Round your answer to one decimal place.) Your Answer: Answer Question 24 (3 points) Gavrilovic is an all-equity firm with 114 million shares outstanding. Gavrilovic has $207 million in cash and expects future free cash flows of $64 million per year. Management plans to use the cash to expand the firm's operations, which will in turn increase future free cash flows to $67 million per year. If the cost of capital of Gavrilovic's investments is 11%, by how much would a decision to pay out the cash to the investors, rather than use it for the expansion, change the the per/share value held by investors? (Please use the absolute value of the change and round to two decimal places) Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts