Question: Question 23 (7 points) Under normal conditions (60% probability), Financing Plan A will produce a $30,000 higher return than Plan B. Under tight money conditions

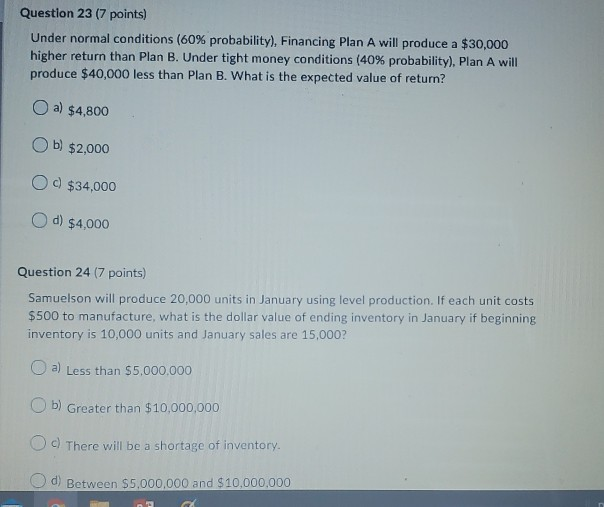

Question 23 (7 points) Under normal conditions (60% probability), Financing Plan A will produce a $30,000 higher return than Plan B. Under tight money conditions (40% probability), Plan A will produce $40,000 less than Plan B. What is the expected value of return? a) $4,800 Ob) $2,000 O $34.000 d) $4.000 Question 24 (7 points) Samuelson will produce 20,000 units in January using level production. If each unit costs $500 to manufacture, what is the dollar value of ending inventory in January if beginning inventory is 10,000 units and January sales are 15,000? a) Less than $5,000,000 b) Greater than $10,000,000 There will be a shortage of inventory. d) Between $5,000,000 and $10,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts