Question: Question 23 (9 points) Excelsior Pulp and Paper Limited (EPP) wants to expand its operations. It is considering the purchase of mulching and pressing machine

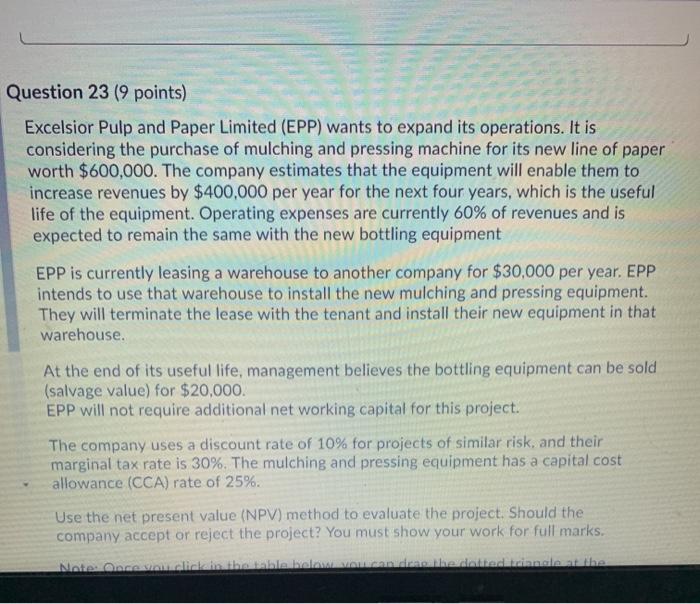

Question 23 (9 points) Excelsior Pulp and Paper Limited (EPP) wants to expand its operations. It is considering the purchase of mulching and pressing machine for its new line of paper worth $600,000. The company estimates that the equipment will enable them to increase revenues by $400,000 per year for the next four years, which is the useful life of the equipment. Operating expenses are currently 60% of revenues and is expected to remain the same with the new bottling equipment EPP is currently leasing a warehouse to another company for $30,000 per year. EPP intends to use that warehouse to install the new mulching and pressing equipment. They will terminate the lease with the tenant and install their new equipment in that warehouse. At the end of its useful life, management believes the bottling equipment can be sold (salvage value) for $20,000. EPP will not require additional net working capital for this project. The company uses a discount rate of 10% for projects of similar risk, and their marginal tax rate is 30%. The mulching and pressing equipment has a capital cost allowance (CCA) rate of 25%. Use the net present value (NPV) method to evaluate the project. Should the company accept or reject the project? You must show your work for full marks. Nate. Oncesionaliokabbala balvu cendence dance the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts