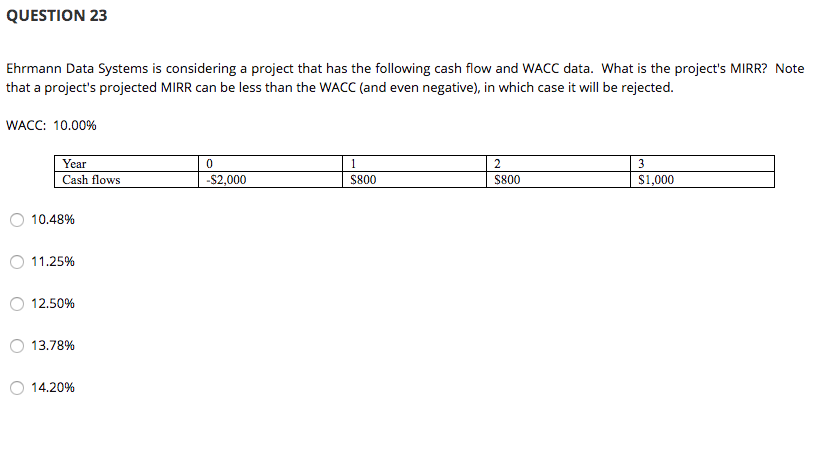

Question: QUESTION 23 Ehrmann Data Systems is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Note that

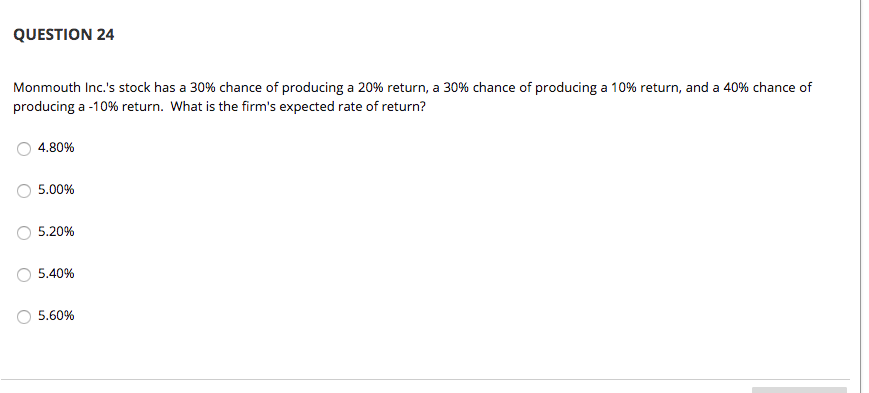

QUESTION 23 Ehrmann Data Systems is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative), in which case it will be rejected. WACC: 10.00% Year 0 e sh flows S2,000 $800 $800 $1,000 Cash flows -$2,000 $800 $800 $1,000 10.48% 11.25% 12.50% O 13.78% O 14.20% QUESTION 24 Monmouth Inc.'s stock has a 30% chance of producing a 20% return, a 30% chance of producing a 10% return, and a 40% chance of producing a -10% return. What is the firm's expected rate of return? 4.80% 0 5.00% 0 5.20% 0 5.40% 0 5.60%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts