Question: QUESTION 23 Problem 18-43 (Algorithmic) (LO. 1, 2) In January of the current year, Wanda transferred machinery worth $262,500 (basis of $39,375 ) to a

QUESTION 23

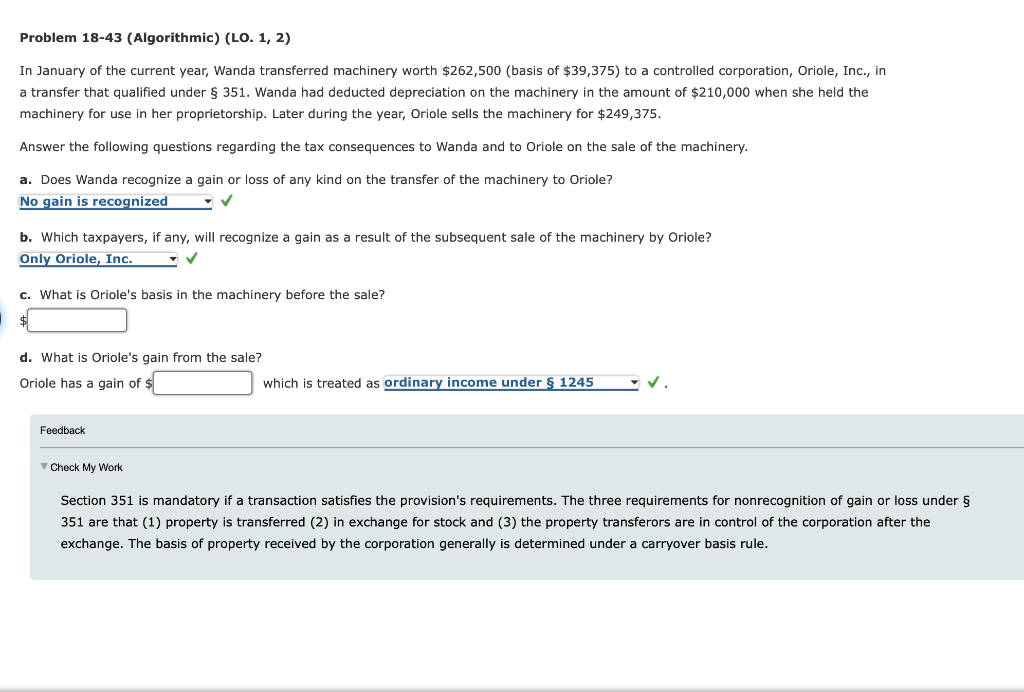

Problem 18-43 (Algorithmic) (LO. 1, 2) In January of the current year, Wanda transferred machinery worth $262,500 (basis of $39,375 ) to a controlled corporation, Oriole, Inc., in a transfer that qualified under 351. Wanda had deducted depreciation on the machinery in the amount of $210,000 when she held the machinery for use in her proprietorship. Later during the year, Oriole sells the machinery for $249,375. Answer the following questions regarding the tax consequences to Wanda and to Oriole on the sale of the machinery. a. Does Wanda recognize a gain or loss of any kind on the transfer of the machinery to Oriole? b. Which taxpayers, if any, will recognize a gain as a result of the subsequent sale of the machinery by Oriole? c. What is Oriole's basis in the machinery before the sale? $ d. What is Oriole's gain from the sale? Oriole has a gain of $ which is treated as Feedback 7 Check My Work Section 351 is mandatory if a transaction satisfies the provision's requirements. The three requirements 351 are that (1) property is transferred (2) in exchange for stock and (3) the property transferors are in control of the corporation after the exchange. The basis of property received by the corporation generally is determined under a carryover basis rule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts