Question: Question 24 1 points Save Answer You are a currency trader with $1,000,000 (or the euro-equivalent amount) of available funds to borrow for one year.

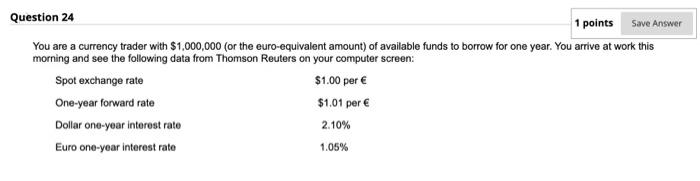

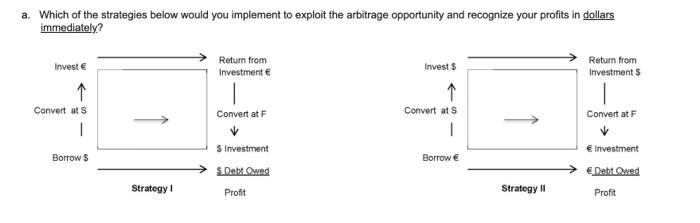

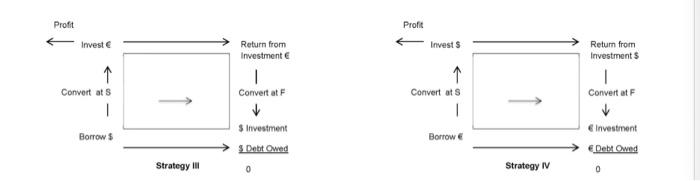

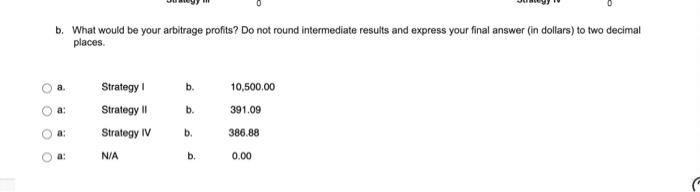

Question 24 1 points Save Answer You are a currency trader with $1,000,000 (or the euro-equivalent amount) of available funds to borrow for one year. You arrive at work this morning and see the following data from Thomson Reuters on your computer screen: Spot exchange rate $1.00 per One-year forward rate $1.01 per Dollar one-year interest rate Euro one-year interest rate 1.05% 2.10% a. Which of the strategies below would you implement to exploit the arbitrage opportunity and recognize your profits in dollars immediately? Return from Investments Investe Convert ats 1 Return from Investment . Convert at F Invest $ Convert ats 1 Convert at F S Investment Investment Borrow $ Borrowe Debt weg Debt Owed Strategy Profit Strategy 11 Profit Profit Profit Invest Invest Convert at s 1 Return from Investment 1 Convert at F Convert ats 1 Return from Investments 1 Convert at F $ Investment & Investment Borrow $ Borrow Debit Owad Detowed Strategy il 0 Strategy IV 0 b. What would be your arbitrage profits? Do not round intermediate results and express your final answer (in dollars) to two decimal places a b. 10,500.00 Strategy Strategy 11 a: b. 391.09 Strategy IV b. 386.88 a: N/A b. 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts