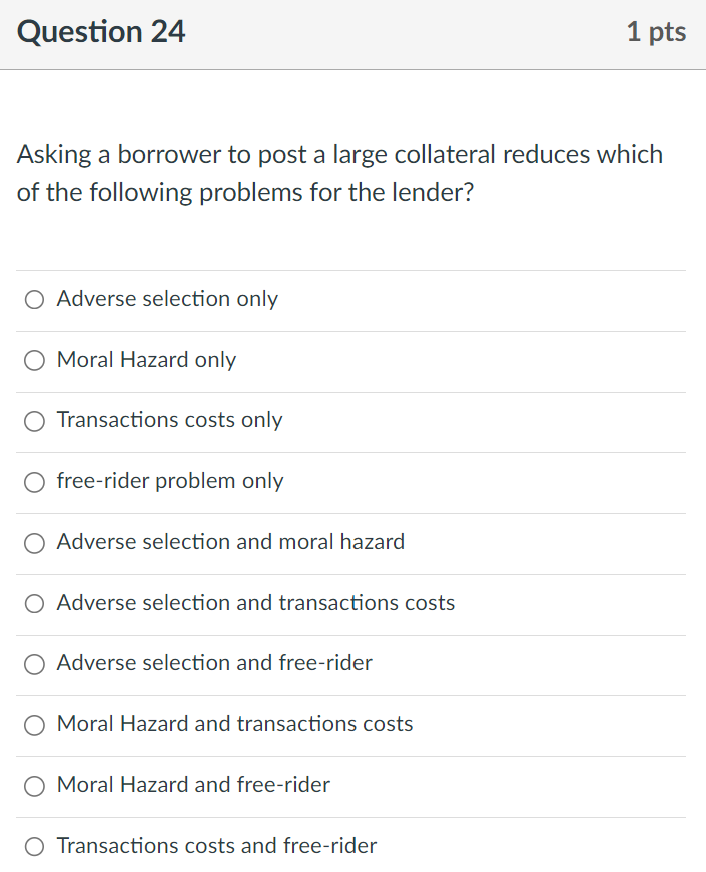

Question: Question 24 1 pts Asking a borrower to post a large collateral reduces which of the following problems for the lender? O Adverse selection only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts