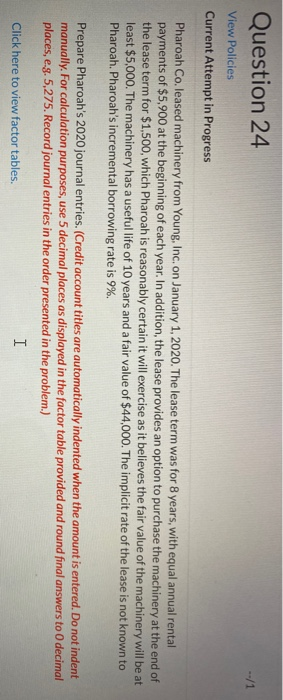

Question: Question 24 --/1 View Policies Current Attempt in Progress Pharoah Co. leased machinery from Young, Inc. on January 1, 2020. The lease term was for

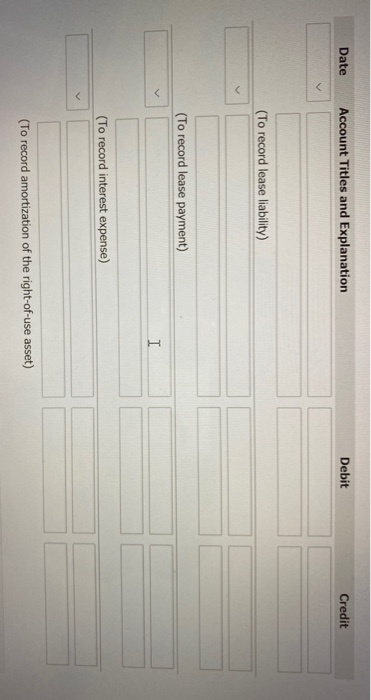

Question 24 --/1 View Policies Current Attempt in Progress Pharoah Co. leased machinery from Young, Inc. on January 1, 2020. The lease term was for 8 years, with equal annual rental payments of $5,900 at the beginning of each year. In addition, the lease provides an option to purchase the machinery at the end of the lease term for $1,500, which Pharoah is reasonably certain it will exercise as it believes the fair value of the machinery will be at least $5,000. The machinery has a useful life of 10 years and a fair value of $44,000. The implicit rate of the lease is not known to Pharoah. Pharoah's incremental borrowing rate is 9%. Prepare Pharoah's 2020 journal entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.) Click here to view factor tables. I Date Account Titles and Explanation Debit Credit (To record lease liability) (To record lease payment) I (To record interest expense) (To record amortization of the right-of-use asset)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts