Question: QUESTION 24 1.429 points Save Answer Over the last five years, an asset had a mean return of 10.5 percent and standard deviation of returns

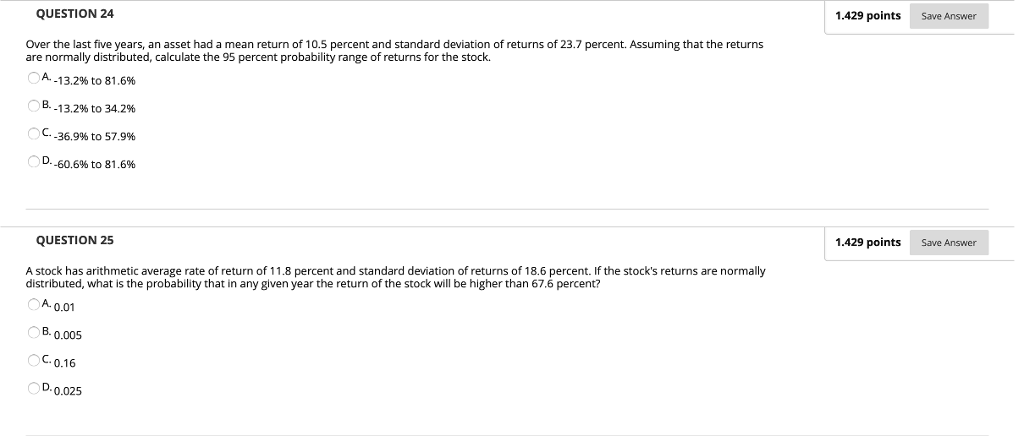

QUESTION 24 1.429 points Save Answer Over the last five years, an asset had a mean return of 10.5 percent and standard deviation of returns of 23.7 percent. Assuming that the returns are normally distributed, calculate the 95 percent probability range of returns for the stock. A.-13.2% to 81.6% -13.2% to 34.2% C-36.9% to 57.9% -D-60.6% to 81.6% B. OC. QUESTION 25 1.429 points Save Answer A stock has arithmetic average rate of return of 11.8 percent and standard deviation of returns of 18.6 percent. If the stock's returns are normally distributed, what is the probability that in any given year the return of the stock will be higher than 67.6 percent? A-0.01 B.0.005 0.16 D.0.025 OA. OC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts