Question: Question 24 (2 points) A settlement squeeze in the credit default swap market is least likely to occur when the CDS contracts are Settled by

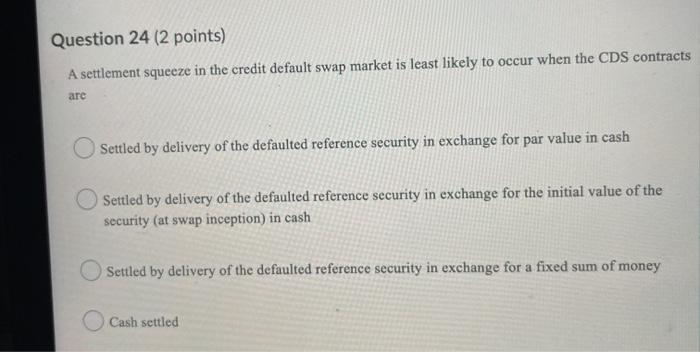

Question 24 (2 points) A settlement squeeze in the credit default swap market is least likely to occur when the CDS contracts are Settled by delivery of the defaulted reference security in exchange for par value in cash Settled by delivery of the defaulted reference security in exchange for the initial value of the security (at swap inception) in cash Settled by delivery of the defaulted reference security in exchange for a fixed sum of money Cash settled

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts