Question: Question 24 2 pts A project requires an initial investment of $650 million and will generate annual after tax free cash flow of $59 million

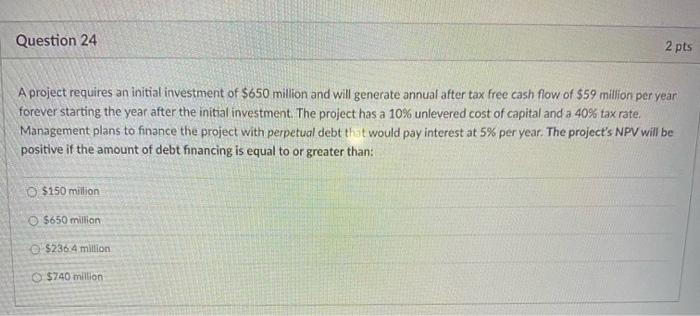

Question 24 2 pts A project requires an initial investment of $650 million and will generate annual after tax free cash flow of $59 million per year forever starting the year after the initial investment. The project has a 10% unlevered cost of capital and a 40% tax rate, Management plans to finance the project with perpetual debt that would pay interest at 5% per year. The project's NPV will be positive if the amount of debt financing is equal to or greater than: $150 million $650 million @ $2364 million $740 million Question 24 2 pts A project requires an initial investment of $650 million and will generate annual after tax free cash flow of $59 million per year forever starting the year after the initial investment. The project has a 10% unlevered cost of capital and a 40% tax rate, Management plans to finance the project with perpetual debt that would pay interest at 5% per year. The project's NPV will be positive if the amount of debt financing is equal to or greater than: $150 million $650 million @ $2364 million $740 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts