Question: Question 24 2 pts Compared to benchmark Treasuries at a given maturity horizon, the risk factor that most often leads to the largest yield adjustment

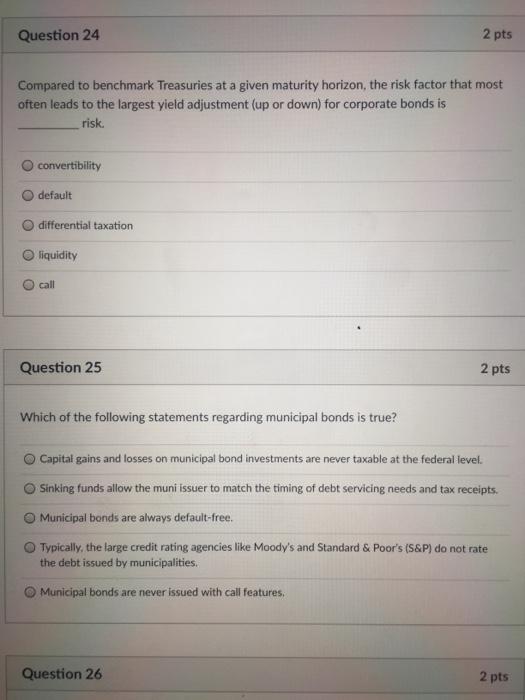

Question 24 2 pts Compared to benchmark Treasuries at a given maturity horizon, the risk factor that most often leads to the largest yield adjustment (up or down) for corporate bonds is risk convertibility default differential taxation liquidity call Question 25 2 pts Which of the following statements regarding municipal bonds is true? Capital gains and losses on municipal bond investments are never taxable at the federal level. Sinking funds allow the muni issuer to match the timing of debt servicing needs and tax receipts. Municipal bonds are always default-free. Typically, the large credit rating agencies like Moody's and Standard & Poor's (S&P) do not rate the debt issued by municipalities. Municipal bonds are never issued with call features Question 26 2 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts