Question: Question 24 3 pts Three project managers approach you about investment opportunities that they believe are value-enhancing for the firm. The cash flows for each

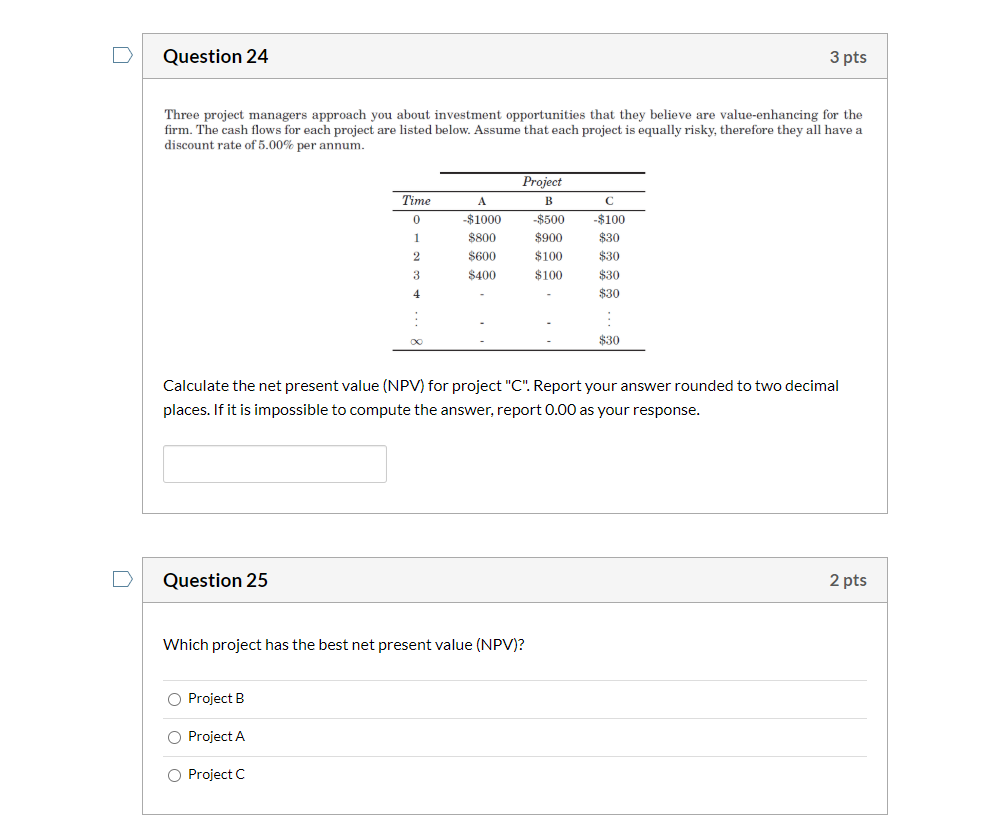

Question 24 3 pts Three project managers approach you about investment opportunities that they believe are value-enhancing for the firm. The cash flows for each project are listed below. Assume that each project is equally risky, therefore they all have a discount rate of 5.00% per annum. Time 0 Project B -$500 $900 $100 $100 $1000 $800 $600 $400 1 2 $100 $30 $30 $30 3 4 $30 : $30 Calculate the net present value (NPV) for project "C". Report your answer rounded to two decimal places. If it is impossible to compute the answer, report 0.00 as your response. Question 25 2 pts Which project has the best net present value (NPV)? O Project B O Project A O Project C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts