Question: Question 24 (4 points) Saved Jeremy Co. is having a hard time collecting its outstanding accounts receivables from its customers. Jeremy decides to factor $110,000

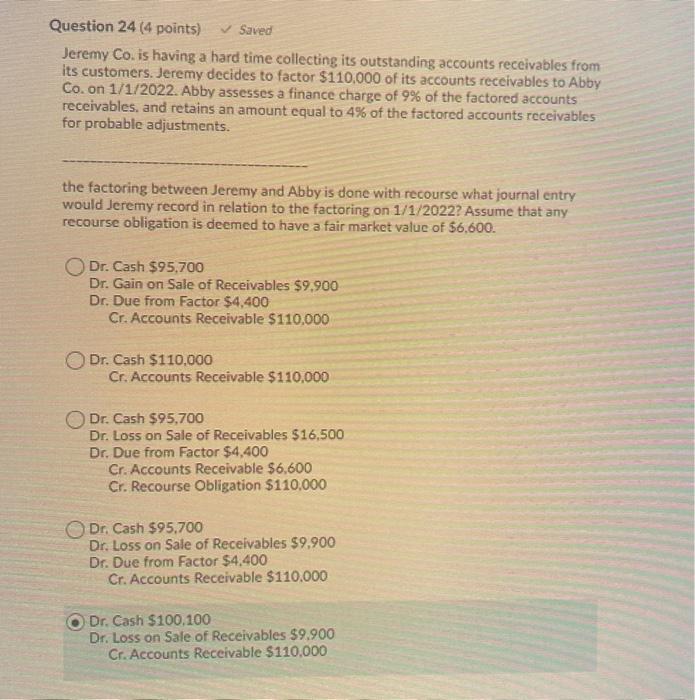

Question 24 (4 points) Saved Jeremy Co. is having a hard time collecting its outstanding accounts receivables from its customers. Jeremy decides to factor $110,000 of its accounts receivables to Abby Co. on 1/1/2022. Abby assesses a finance charge of 9% of the factored accounts receivables, and retains an amount equal to 4% of the factored accounts receivables for probable adjustments. the factoring between Jeremy and Abby is done with recourse what journal entry would Jeremy record in relation to the factoring on 1/1/2022? Assume that any recourse obligation is deemed to have a fair market value of $6,600. Dr. Cash $95.700 Dr. Gain on Sale of Receivables $9.900 Dr. Due from Factor $4,400 Cr. Accounts Receivable $110.000 Dr. Cash $110,000 Cr. Accounts Receivable $110,000 Dr. Cash $95,700 Dr. Loss on Sale of Receivables $16,500 Dr. Due from Factor $4,400 Cr. Accounts Receivable $6,600 Cr. Recourse Obligation $110,000 O Dr. Cash 595,700 Dr. Loss on Sale of Receivables $9.900 Dr. Due from Factor $4,400 Cr. Accounts Receivable $110.000 Dr. Cash $100,100 Dr. Loss on Sale of Receivables $9.900 Cr. Accounts Receivable $110,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts