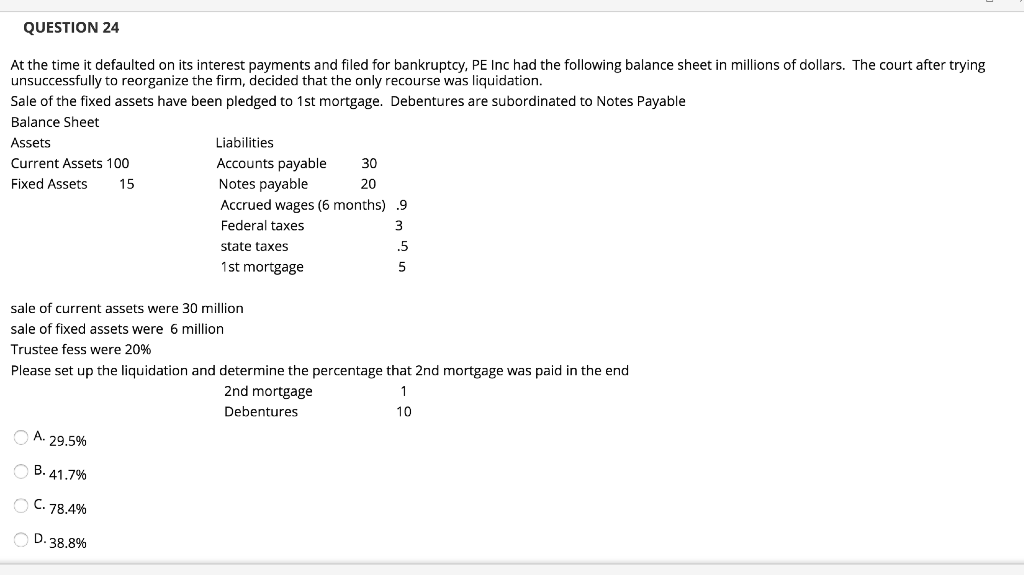

Question: QUESTION 24 At the time it defaulted on its interest payments and filed for bankruptcy, PE Inc had the following balance sheet in millions of

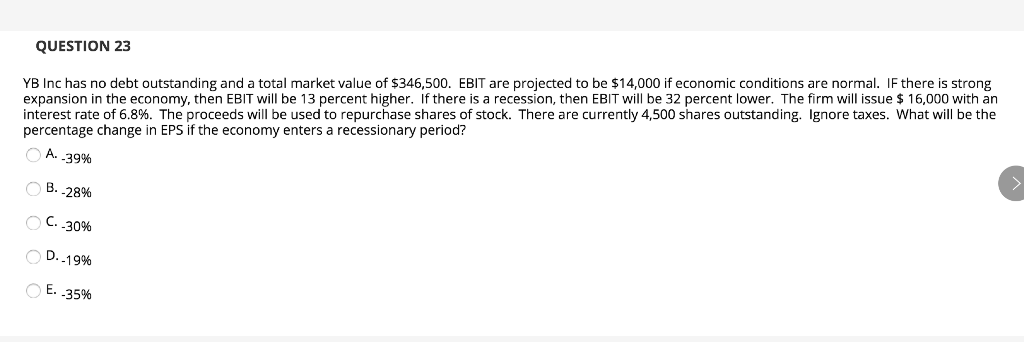

QUESTION 24 At the time it defaulted on its interest payments and filed for bankruptcy, PE Inc had the following balance sheet in millions of dollars. The court after trying unsuccessfully to reorganize the firm, decided that the only recourse was liquidation. Sale of the fixed assets have been pledged to 1st mortgage. Debentures are subordinated to Notes Payable Balance Sheet Assets Liabilities Current Assets 100 Accounts payable 30 Fixed Assets 15 Notes payable Accrued wages (6 months) .9 Federal taxes state taxes 1st mortgage 20 un in woo sale of current assets were 30 million sale of fixed assets were 6 million Trustee fess were 20% Please set up the liquidation and determine the percentage that 2nd mortgage was paid in the end 2nd mortgage Debentures 10 A. 29.5% B.41.7% OC. 78.4% D. 38.8% QUESTION 23 YB Inc has no debt outstanding and a total market value of $346,500. EBIT are projected to be $14,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 13 percent higher. If there is a recession, then EBIT will be 32 percent lower. The firm will issue $ 16,000 with an interest rate of 6.8%. The proceeds will be used to repurchase shares of stock. There are currently 4,500 shares outstanding. Ignore taxes. What will be the percentage change in EPS if the economy enters a recessionary period? A. -39% B. -28% -30% D.-19% E. -35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts