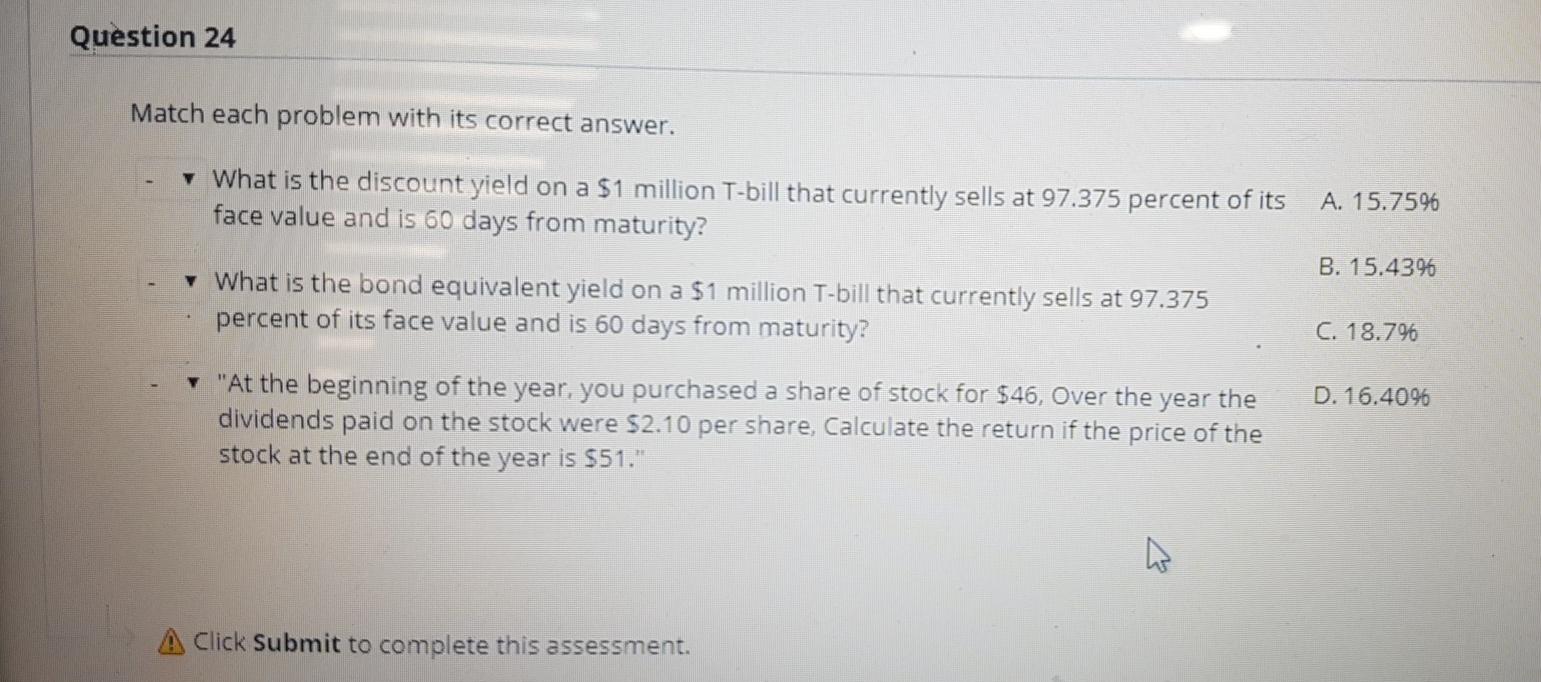

Question: Question 24 Match each problem with its correct answer. What is the discount yield on a $1 million T-bill that currently sells at 97.375 percent

Question 24 Match each problem with its correct answer. What is the discount yield on a $1 million T-bill that currently sells at 97.375 percent of its face value and is 60 days from maturity? A. 15.7596 B. 15.4396 What is the bond equivalent yield on a $1 million T-bill that currently sells at 97.375 percent of its face value and is 60 days from maturity? C. 18.796 year the D. 16.4046 "At the beginning of the year, you purchased a share of stock for $46, Over the dividends paid on the stock were 52.10 per share, Calculate the return if the price of the stock at the end of the year is 551." A Click Submit to complete this assessment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts