Question: Question 24: You are choosing between two different loans with identical terms, except the interest rates are different. Loan A has a rate of 6.40%

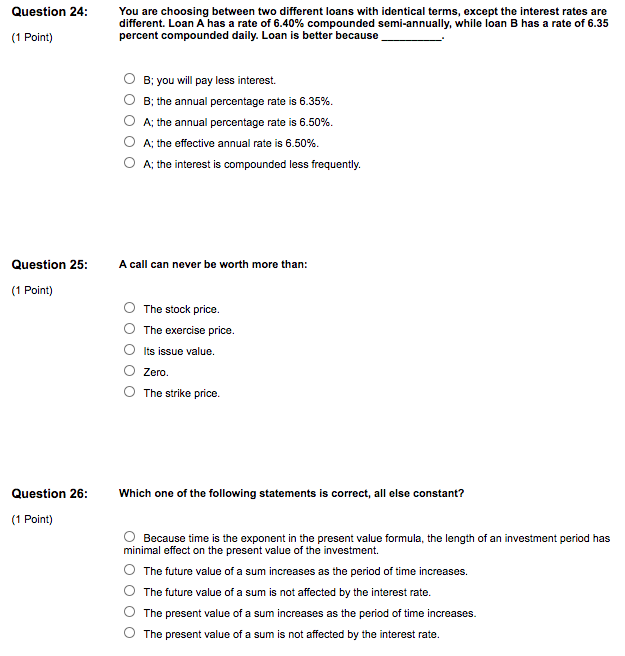

Question 24: You are choosing between two different loans with identical terms, except the interest rates are different. Loan A has a rate of 6.40% compounded semi-annually, while loan B has a rate of 6.35 percent compounded daily. Loan is better because (1 Point) B; you will pay less interest. B; the annual percentage rate is 6.35%. A; the annual percentage rate is 6.50%. A; the effective annual rate is 6.50%. A; the interest is compounded less frequently Question 25: A call can never be worth more than: (1 Point) The stock price. The exercise price. Its issue value. Zero. The strike price. Question 26: Which one of the following statements is correct, all else constant? (1 Point) Because time is the exponent in the present value formula, the length of an investment period has minimal effect on the present value of the investment. The future value of a sum increases as the period of time increases. The future value of a sum is not affected by the interest rate. The present value of a sum increases as the period of time increases. The present value of a sum is not affected by the interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts