Question: Question 25 (1 point) During 2018, WW Inc. reduced its LIFO eligible inventory quantities due to a problem with its major supplier. The effect of

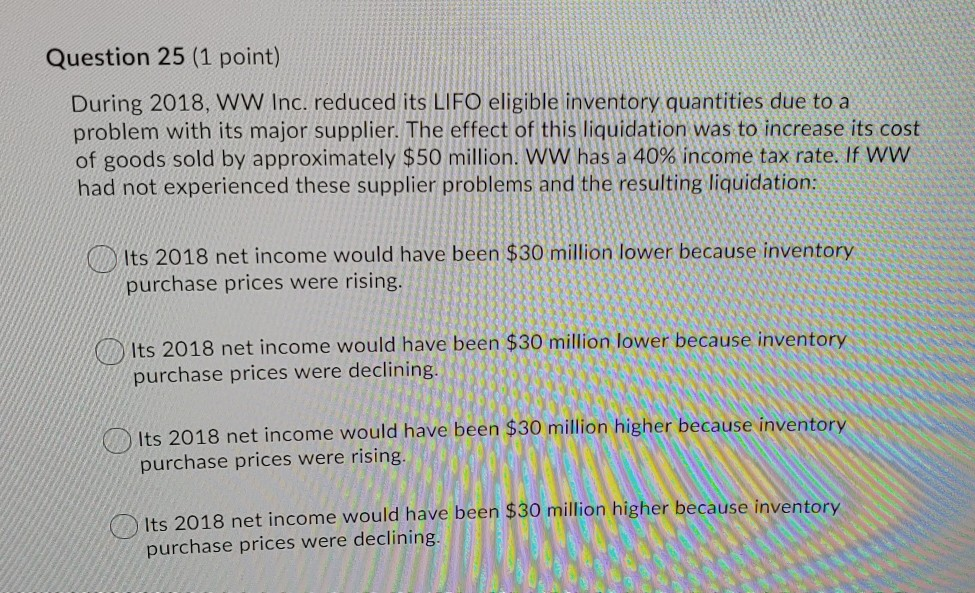

Question 25 (1 point) During 2018, WW Inc. reduced its LIFO eligible inventory quantities due to a problem with its major supplier. The effect of this liquidation was to increase its cost of goods sold by approximately $50 million. WW has a 40% income tax rate. If WW had not experienced these supplier problems and the resulting liquidation: Its 2018 net income would have been $30 million lower because inventory purchase prices were rising. SSS Its 2018 net income would have been $30 million lower because inventory purchase prices were declining. Its 2018 net income would have been $30 million higher because inventory purchase prices were rising. Its 2018 net income would have been $30 million higher because inventory purchase prices were declining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts