Question: QUESTION 25 1points Save Answer A Treasury bond has a quoted price of 101.6523 and current yield of 5.875 percent. What is the bond's annual

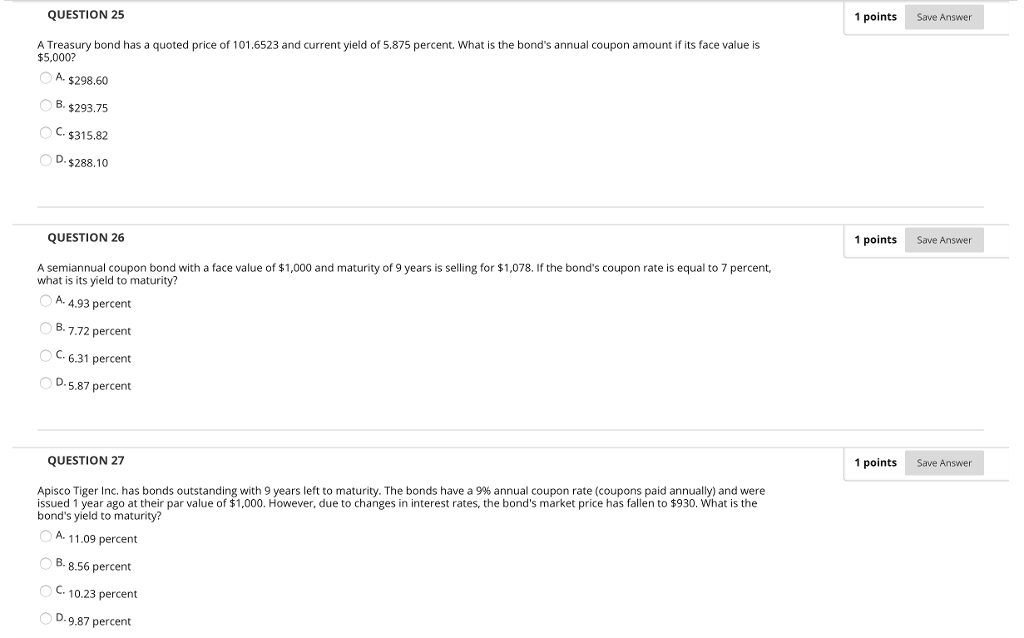

QUESTION 25 1points Save Answer A Treasury bond has a quoted price of 101.6523 and current yield of 5.875 percent. What is the bond's annual coupon amount if its face value is $5,000? A. $298.60 B. $293.75 $315.82 D. $288.10 QUESTION 26 1 points Save Answer A semiannual coupon bond with a face value of $1,000 and maturity of 9 years is selling for $1,078. If the bond's coupon rate is equal to 7 percent, what is its yield to maturity? A. 4.93 percent B. 7.72 percent 6.31 percent D.5.87 percent QUESTION 27 points Save Answer Apisco Tiger Inc. has bonds outstanding with 9 years left to maturity. The bonds have a 9% annual coupon rate (coupons paid annually) and were issued 1 year ago at their par value of $1,000. However, due to changes in interest rates, the bond's market price has fallen to $930. What is the bond's yield to maturity? A. 11.09 percent B. 8.56 percent 10.23 percent D.9.87 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts