Question: Question 25 2 pts Consider this definition from a source other than your textbook: a type of fixed- income ownership security in a corporation that

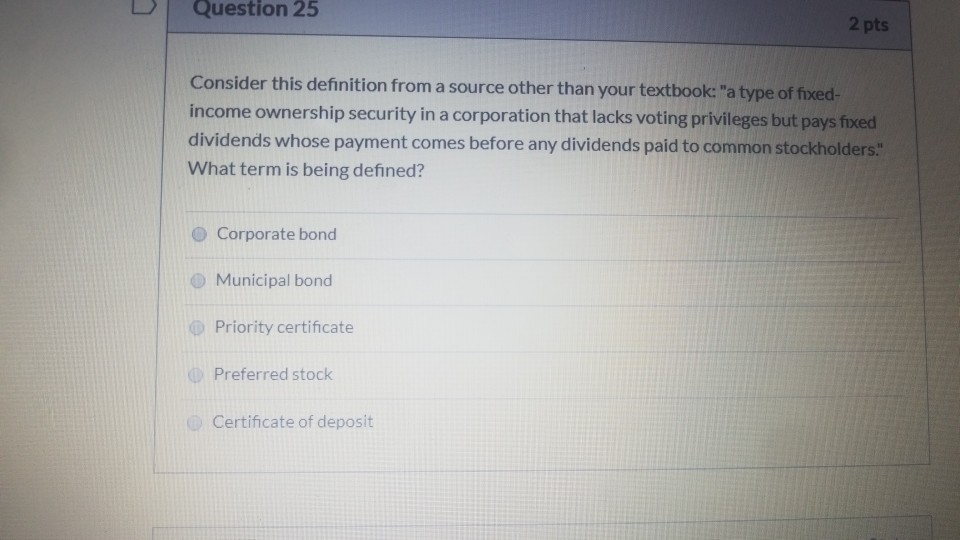

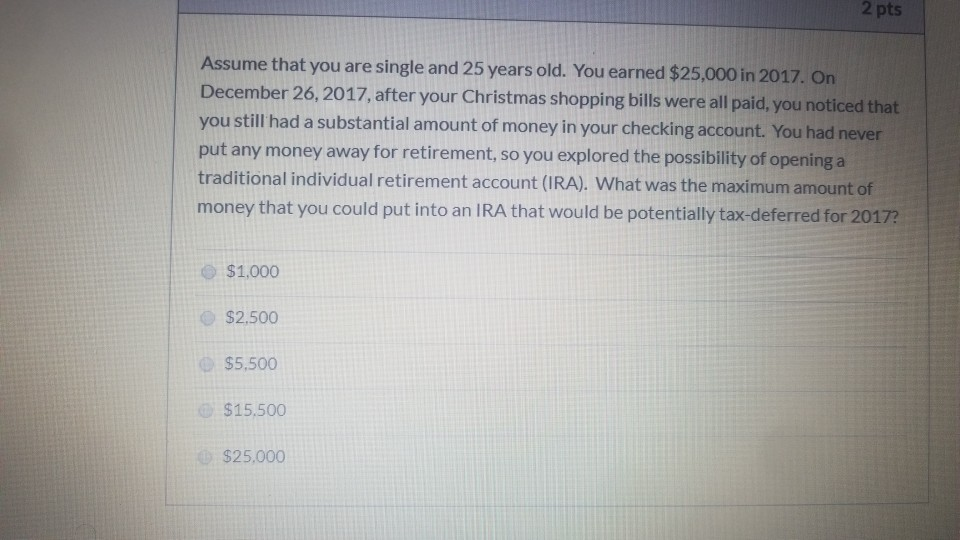

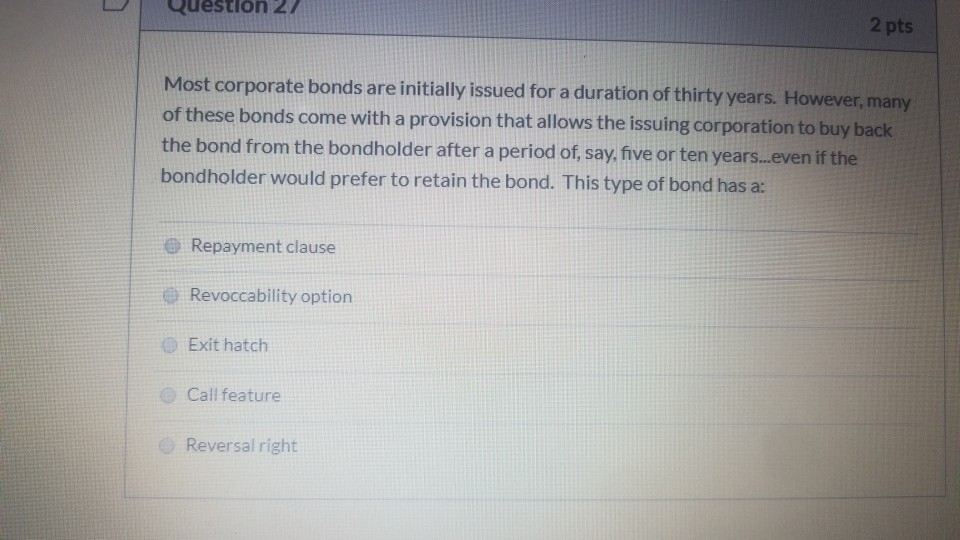

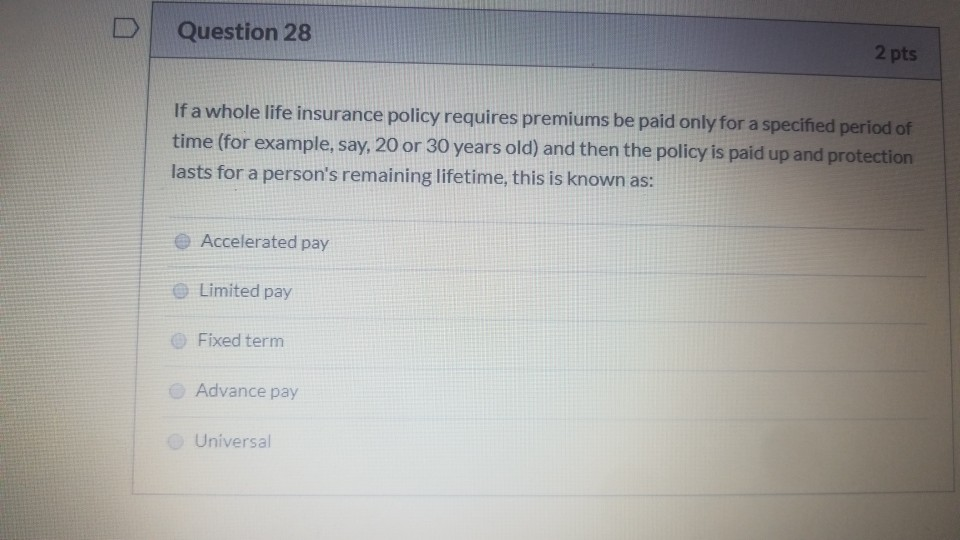

Question 25 2 pts Consider this definition from a source other than your textbook: "a type of fixed- income ownership security in a corporation that lacks voting privileges but pays fixed dividends whose payment comes before any dividends paid to common stockholders." What term is being defined? Corporate bond Municipal bond Priority certificate Preferred stock Certificate of deposit - Pes Assume that you are single and 25 years old. You earned $25,000 in 2017. On December 26, 2017, after your Christmas shopping bills were all paid, you noticed that you still had a substantial amount of money in your checking account. You had never put any money away for retirement, so you explored the possibility of opening a traditional individual retirement account (IRA). What was the maximum amount of money that you could put into an IRA that would be potentially tax-deferred for 2017? $1,000 $2,500 $5,500 $15.500 $25,000 Question 27 2 pts Most corporate bonds are initially issued for a duration of thirty years. However, many of these bonds come with a provision that allows the issuing corporation to buy back the bond from the bondholder after a period of, say, five or ten years...even if the bondholder would prefer to retain the bond. This type of bond has a: Repayment clause Revoccability option Exit hatch Call feature Reversal right Question 28 2 pts If a whole life insurance policy requires premiums be paid only for a specified period of time (for example, say, 20 or 30 years old) and then the policy is paid up and protection lasts for a person's remaining lifetime, this is known as: Accelerated pay Limited pay Fixed term Advance pay Universal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts