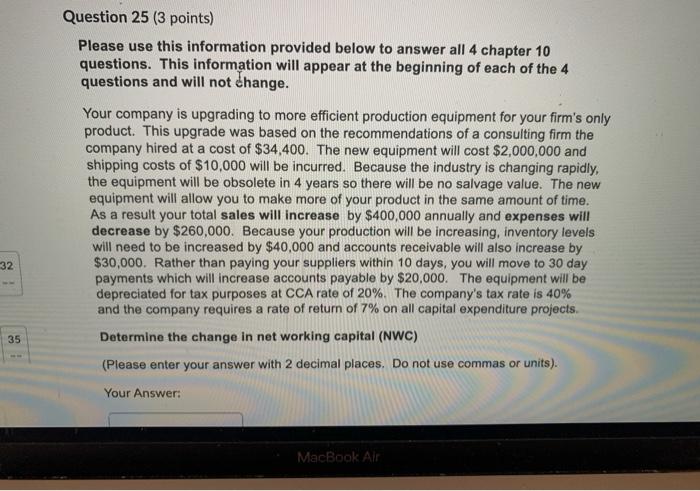

Question: Question 25 (3 points) Please use this information provided below to answer all 4 chapter 10 questions. This information will appear at the beginning of

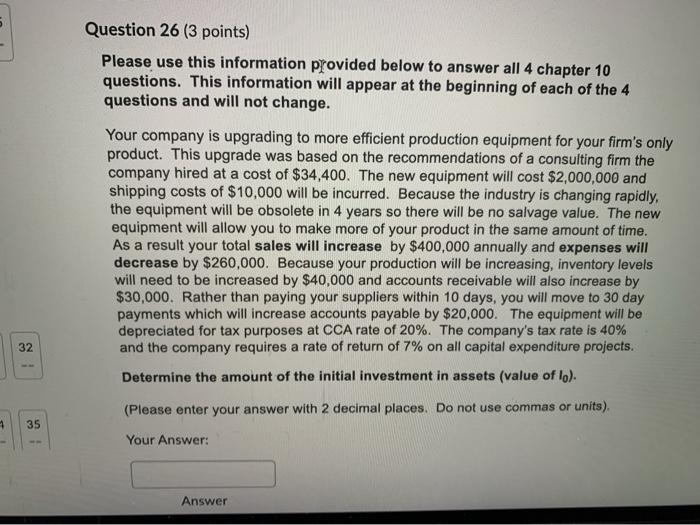

Question 25 (3 points) Please use this information provided below to answer all 4 chapter 10 questions. This information will appear at the beginning of each of the 4 questions and will not change. Your company is upgrading to more efficient production equipment for your firm's only product. This upgrade was based on the recommendations of a consulting firm the company hired at a cost of $34,400. The new equipment will cost $2,000,000 and shipping costs of $10,000 will be incurred. Because the industry is changing rapidly, the equipment will be obsolete in 4 years so there will be no salvage value. The new equipment will allow you to make more of your product in the same amount of time. As a result your total sales will increase by $400,000 annually and expenses will decrease by $260,000. Because your production will be increasing, inventory levels will need to be increased by $40,000 and accounts receivable will also increase by $30,000. Rather than paying your suppliers within 10 days, you will move to 30 day payments which will increase accounts payable by $20,000. The equipment will be depreciated for tax purposes at CCA rate of 20%. The company's tax rate is 40% and the company requires a rate of return of 7% on all capital expenditure projects Determine the change in net working capital (NWC) (Please enter your answer with 2 decimal places. Do not use commas or units). 32 35 Your Answer: MacBook Air Question 26 (3 points) Please use this information provided below to answer all 4 chapter 10 questions. This information will appear at the beginning of each of the 4 questions and will not change. Your company is upgrading to more efficient production equipment for your firm's only product. This upgrade was based on the recommendations of a consulting firm the company hired at a cost of $34,400. The new equipment will cost $2,000,000 and shipping costs of $10,000 will be incurred. Because the industry is changing rapidly, the equipment will be obsolete in 4 years so there will be no salvage value. The new equipment will allow you to make more of our product in the same amount of time. As a result your total sales will increase by $400,000 annually and expenses will decrease by $260,000. Because your production will be increasing, inventory levels will need to be increased by $40,000 and accounts receivable will also increase by $30,000. Rather than paying your suppliers within 10 days, you will move to 30 day payments which will increase accounts payable by $20,000. The equipment will be depreciated for tax purposes at CCA rate of 20%. The company's tax rate is 40% and the company requires a rate of return of 7% on all capital expenditure projects. Determine the amount of the initial investment in assets (value of lo). 32 (Please enter your answer with 2 decimal places. Do not use commas or units). 35 Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts