Question: Question 25 (3.5 points) Costly Corporation is considering using equity financing. Currently, the firm's stock is selling for $31.00 per share. The firm's dividend for

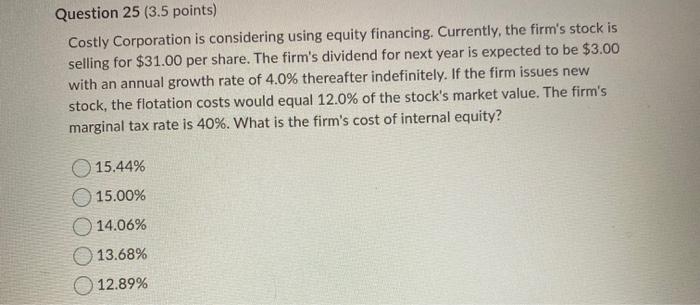

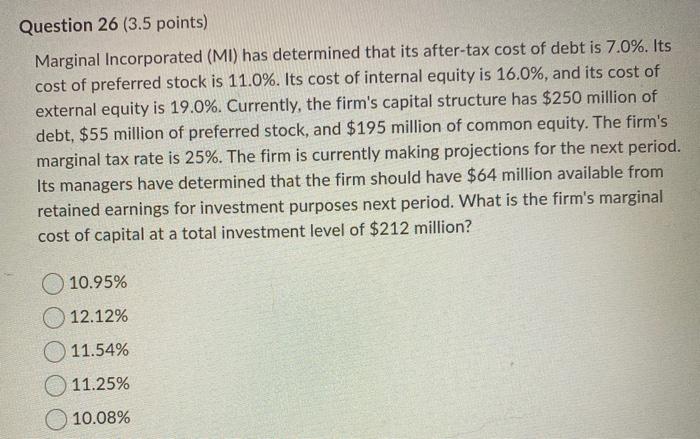

Question 25 (3.5 points) Costly Corporation is considering using equity financing. Currently, the firm's stock is selling for $31.00 per share. The firm's dividend for next year is expected to be $3.00 with an annual growth rate of 4.0% thereafter indefinitely. If the firm issues new stock, the flotation costs would equal 12.0% of the stock's market value. The firm's marginal tax rate is 40%. What is the firm's cost of internal equity? 15.44% 15.00% 14.06% 13.68% 12.89% Question 26 (3.5 points) Marginal Incorporated (MI) has determined that its after-tax cost of debt is 7.0%. Its cost of preferred stock is 11.0%. Its cost of internal equity is 16.0%, and its cost of external equity is 19.0%. Currently, the firm's capital structure has $250 million of debt, $55 million of preferred stock, and $195 million of common equity. The firm's marginal tax rate is 25%. The firm is currently making projections for the next period. Its managers have determined that the firm should have $64 million available from retained earnings for investment purposes next period. What is the firm's marginal cost of capital at a total investment level of $212 million? 10.95% 12.12% 11.54% 11.25% 10.08%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts